What happened in the October sell-off

After “What didn’t happen in February”: What happened in October.

November 12, 2018

Christian Crête

Earlier this year, our article What (didn’t) happen in the February sell-off explained how the stock market decline that had just occurred had been atypical. We argued that markets had kept their “risk-on” tone: Defensive assets did not outperform like they typically would during a true market correction. Since October brought a new episode of turbulence, we felt that a comparison with February would be relevant. As it turns out, October was significantly different than February.

Financial markets were priced for perfection going into October

Led by U.S. equities, global stock markets entered October in good spirits: After a gain of 5.3% in Q3, the February sell-off was a distant memory. But global equity markets declined almost 7% during the month of October (the worst monthly performance since May 2015), bringing the year-to-date return of the MSCI World Index into negative territory (-0.2%).

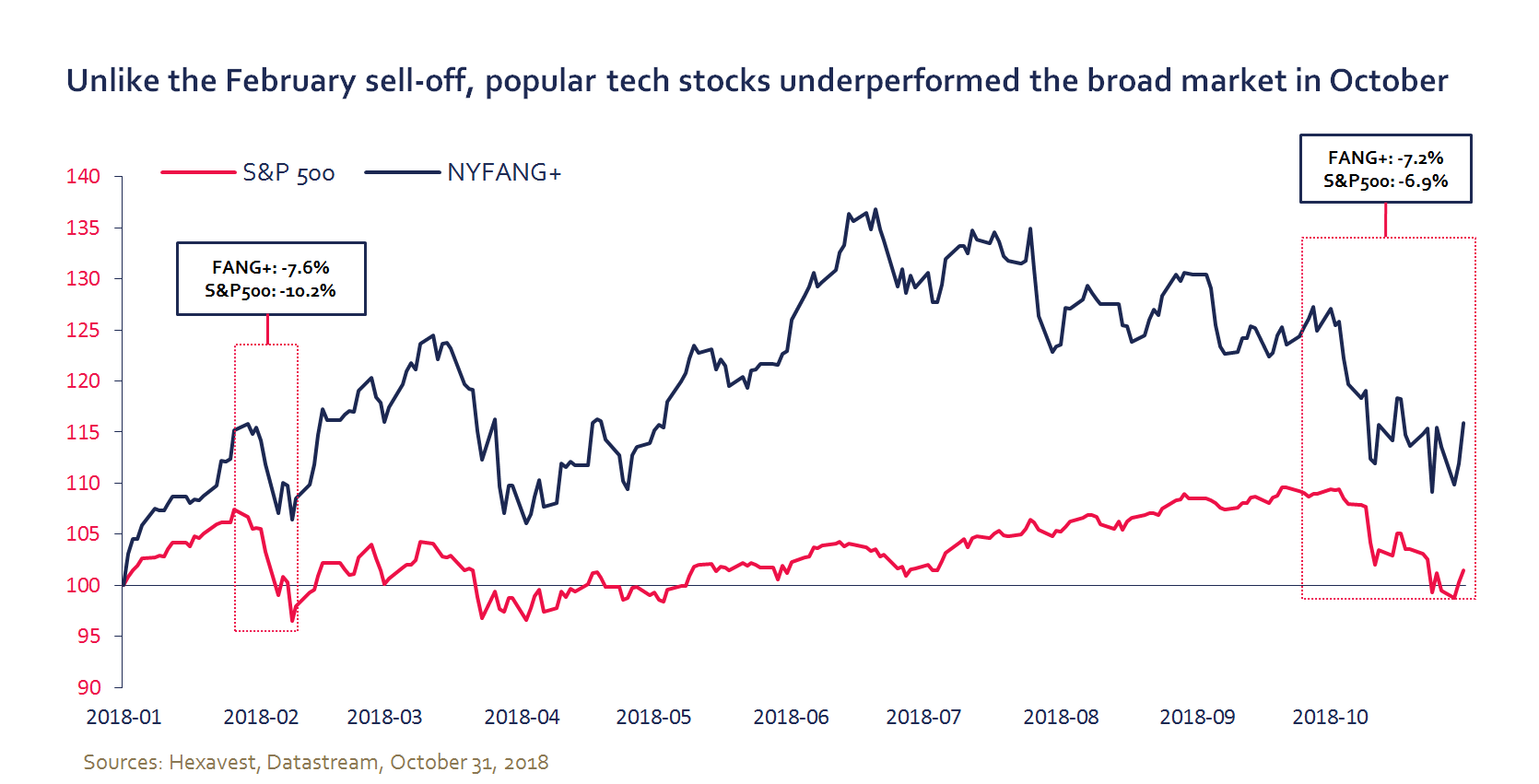

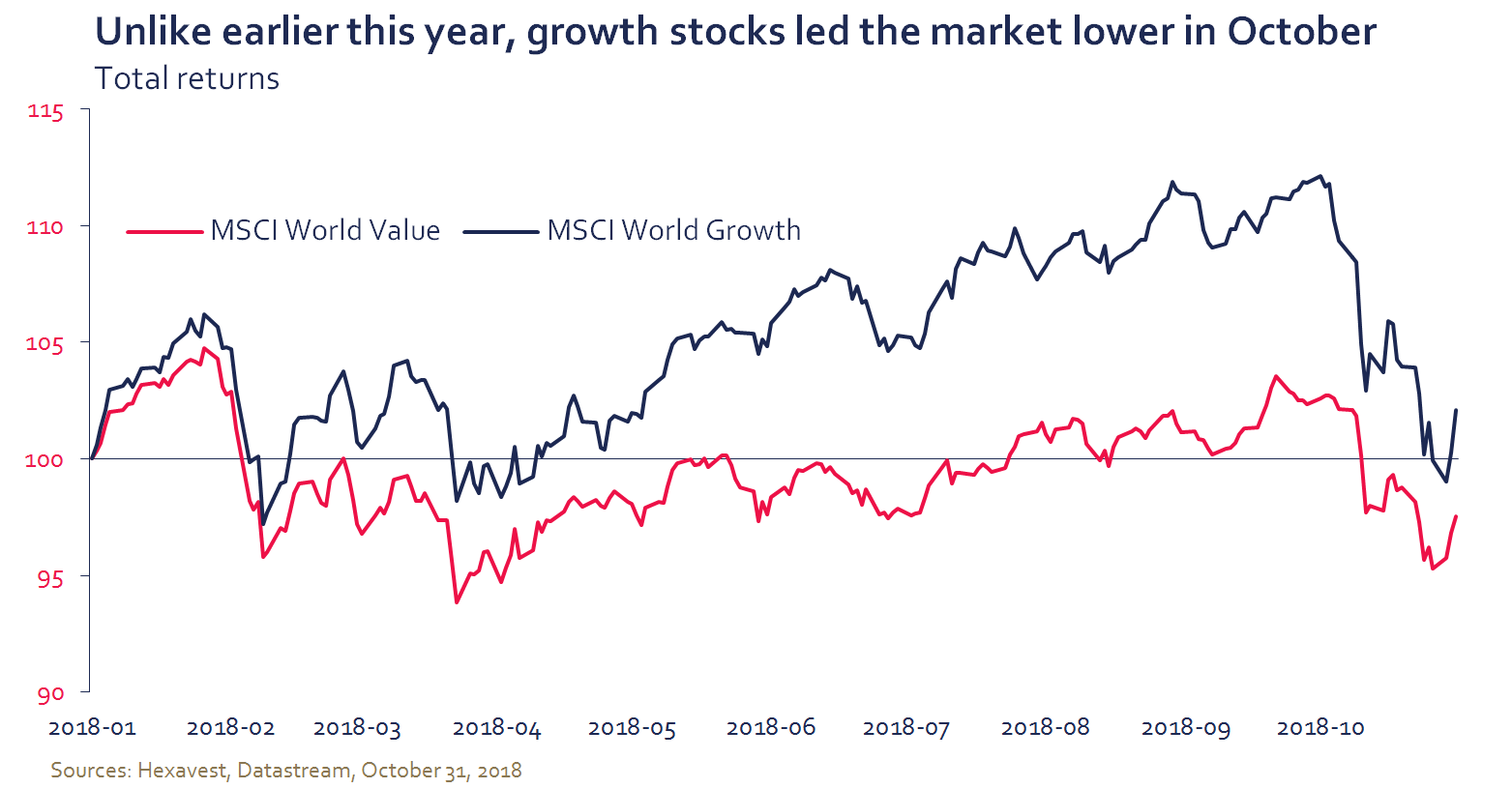

Unlike earlier this year, the recent bout of volatility felt more like a typical correction, with defensive sectors and value stocks largely outperforming their cyclical and growth peers. Even the popular “do no wrong” FANG stocks were not able to avoid the correction.

Let’s analyze the October market environment based on our three usual vectors of analysis: the macroeconomic environment, the valuation of financial markets and the sentiment of investors.

Global economic growth remains solid, but the outlook is darkening

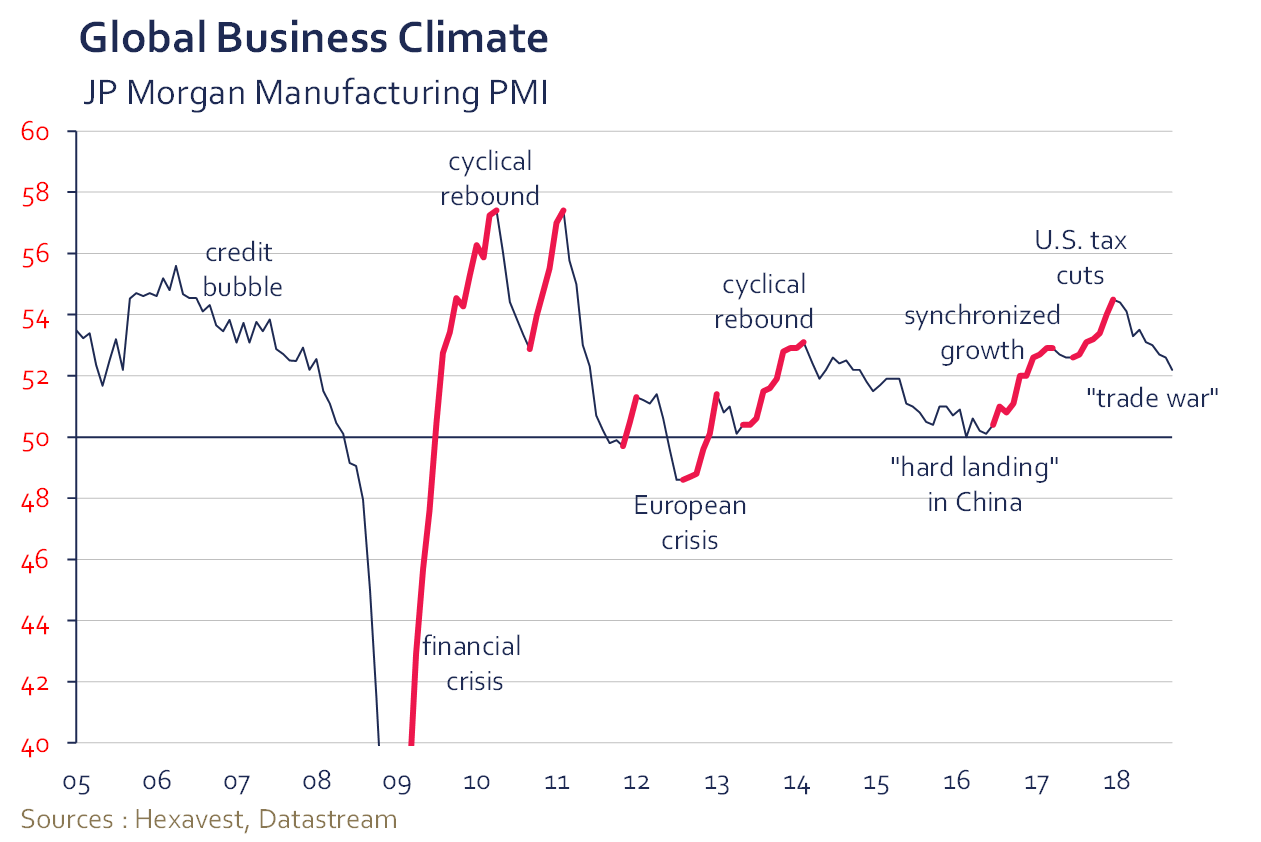

Economic growth remains solid, but dark clouds began to form earlier this year when economic activity outside the U.S. started showing signs of weakness. Business climate indexes peaked in Q1, while talk of trade wars and the rise in protectionist policies accentuated the drop.

According to GDP numbers, global growth no longer seems synchronized and the backdrop for the U.S. economy appears to be as good as it gets. In 2019, we believe U.S. growth will be challenged by tighter financial conditions (U.S. dollar strength, rising interest rates, higher gasoline prices) as well as the negative impact of tariffs on supply chains and corporate investment. Real GDP growth expectations have been revised lower in all regions except the U.S. and we do not expect a sustained decoupling of the U.S. economy from the rest of the world.

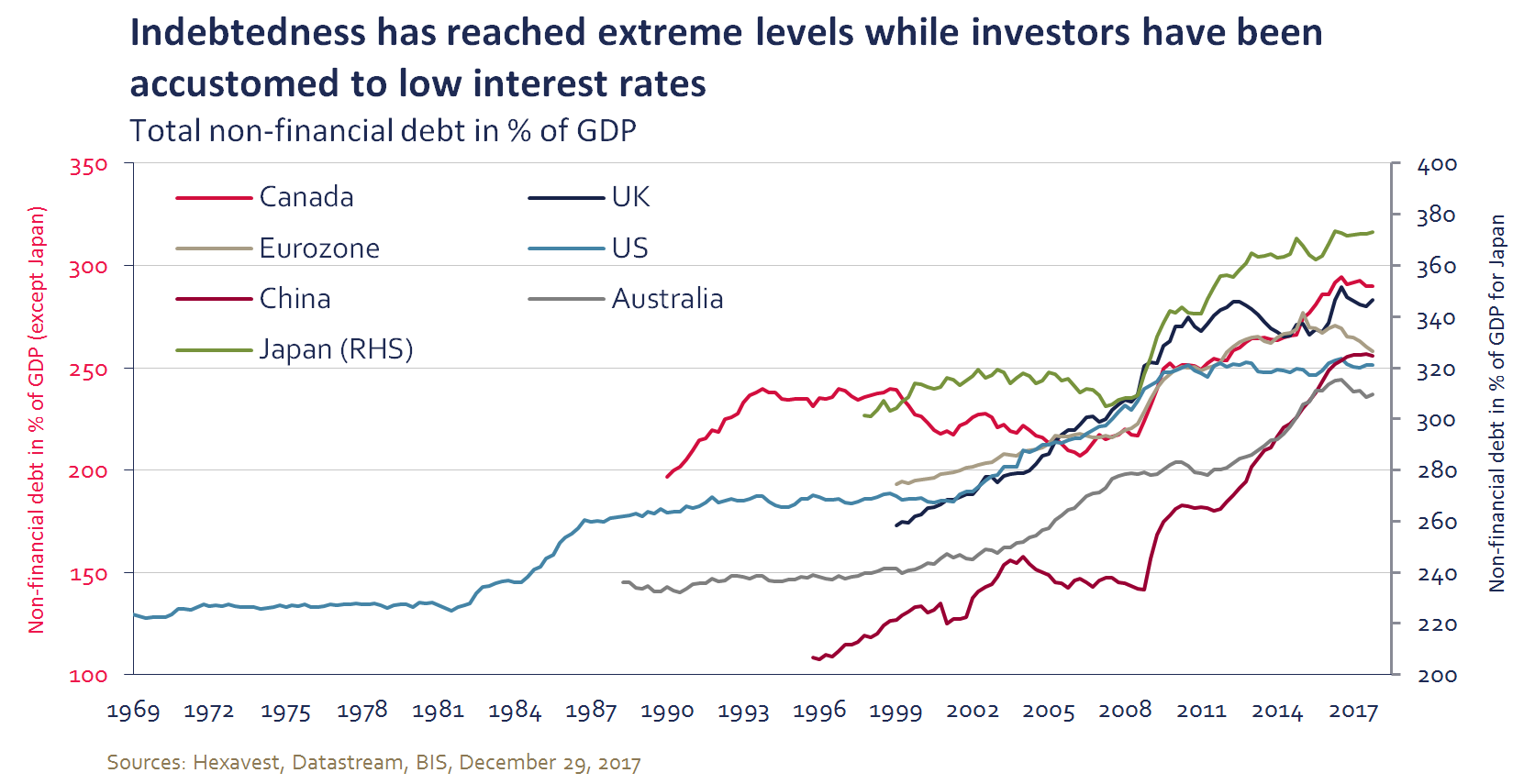

Rising interest rates is another factor weighing on global economic growth. In early October, comments from Federal Reserve Chairman Jerome Powell spooked investors when he suggested there was a long way to go before interest rates became neutral. The result was tighter financial conditions being priced into the future and negative implications for a global economy that has been relying on leverage for the last decade.

Globally, central banks have responded to the sustained economic recovery by increasing interest rates at a rate not experienced since 2011. More than 26 central banks raised rates over the last six months.

Bottom line, we believe the higher probability of a weaker growth backdrop should urge investors to question how the rate increases will impact earnings growth.

Valuation multiples improved

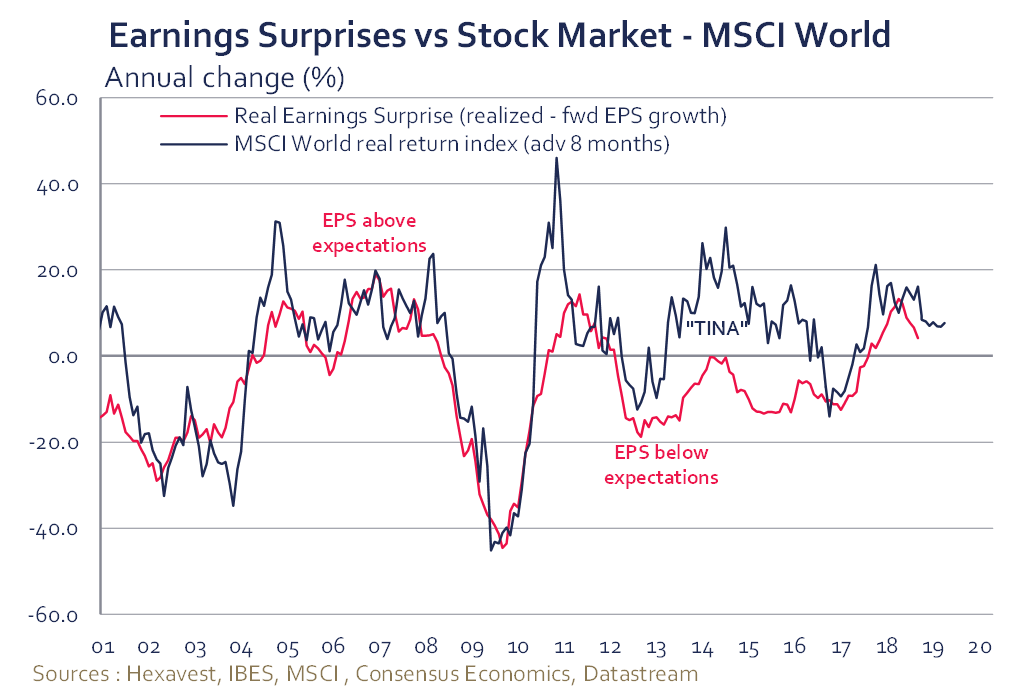

Earnings growth exceeded analysts’ expectations this year for the first time since 2011. At the end of Q3 2018, global equity valuations reflected expectations that profits would exceed analysts’ already-optimistic forecasts (13% growth) by almost 10% over the next three quarters.

However, rising uncertainty for the global economy and a disappointing growth outlook from companies left investors wondering if earnings had peaked. As profit margins stand at a cyclical peak and the cost of doing business is rising (wages, tariffs and transportation), corporations have less room to offset slower topline growth.

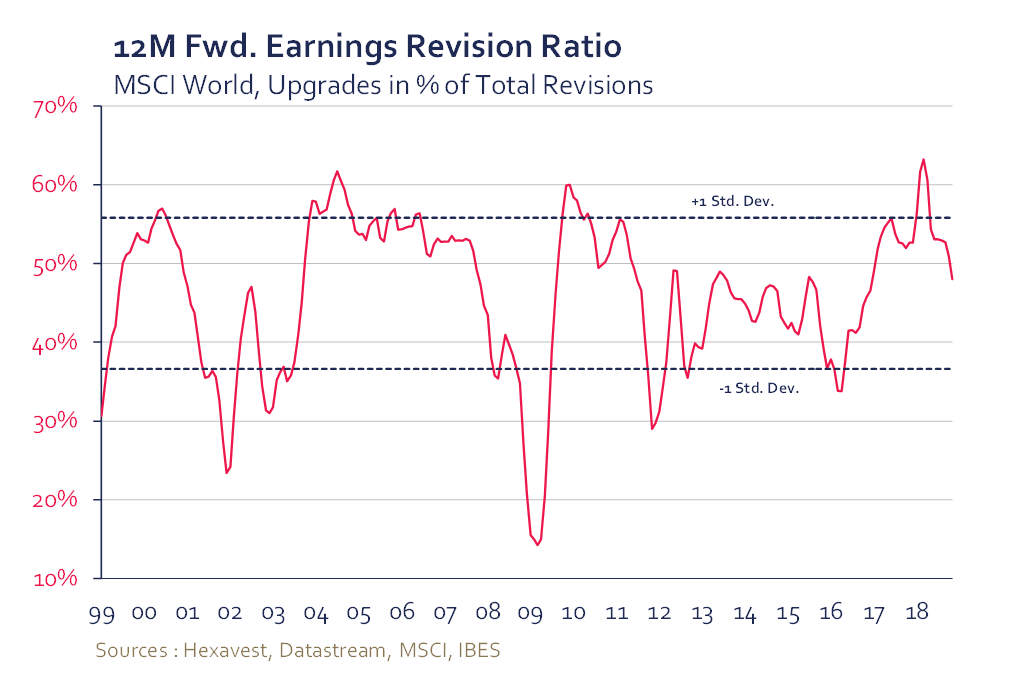

Against this backdrop, earnings growth expectations have been significantly revised lower in recent weeks. For the next 12 months, analysts continue to expect above-average earnings growth for global equities, but estimates have been revised down 5% over the last four weeks. The largest negative revision was for the U.S. market, at 7.5%.

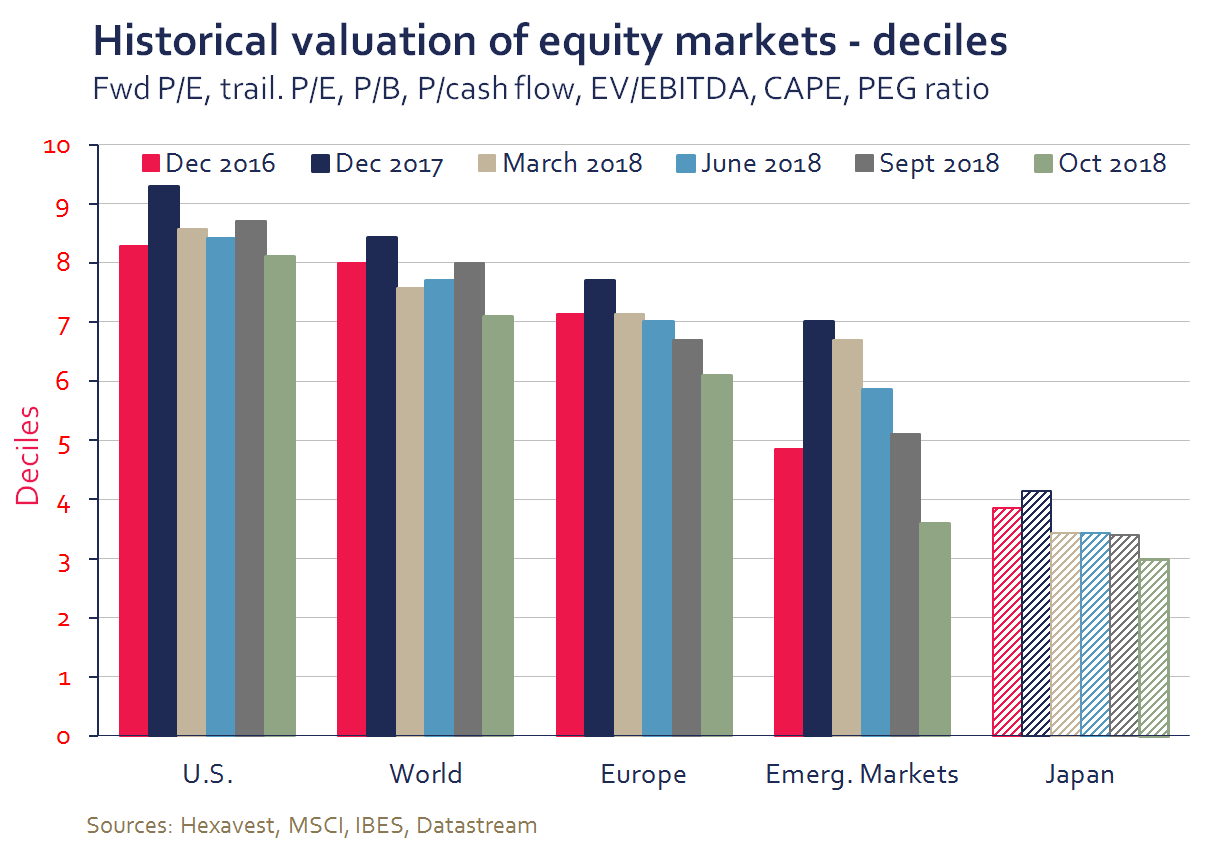

Although U.S. equities remain expensive by historical standards, valuation multiples for global equities have improved following the October correction. The graph below shows that investors need to look outside the U.S. to find attractive investment opportunities.

This time, a change in investor sentiment happened

We believe that the deteriorating economic outlook dulled investors’ appetite for growth stocks. In October, we saw a change in sentiment, as investors rotated into defensive sectors and value stocks. This was in contrast to February, when defensive sectors had underperformed cyclicals and value stocks had not provided protection in the market downturn.

Investors had been getting nervous before the October correction; surveys show that the allocation to risky assets started to decline in the spring. Unlike earlier this year, investors’ concerns seem to have also impacted fixed-income markets. Both corporate and high-yield spreads increased during the month of October, although they remain very low compared to history. However, similar to earlier this year, the increased volatility in equity markets was not matched in other asset classes.

We believe that the risks of contagion are high, as financial engineering strategies increased their allocations to risky assets in recent years. These strategies work well in a stable environment. However, tighter financial conditions increase the probability of a future that is anything but stable.

Historically, when the economic cycle was aging and some segments were starting to overheat, financial markets experienced episodes of increased stress and rising volatility. In our view, February was just a warning shot.

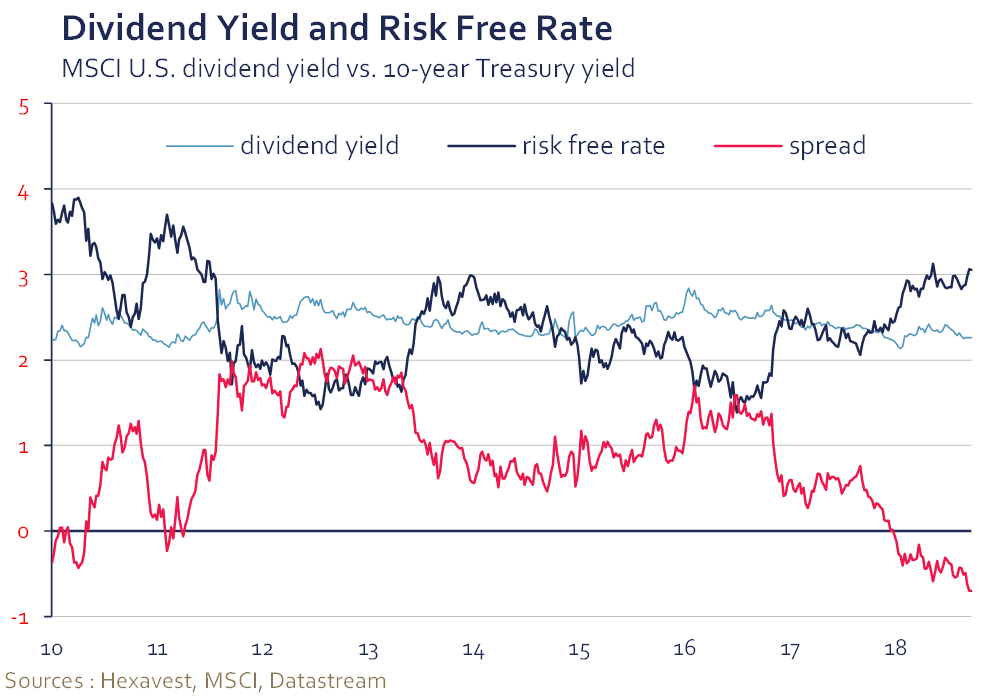

Strategic view: Keeping ready for more to come

Although global equity markets recouped earlier losses in the closing days of October, we expect further downside (especially in the U.S.) as financial markets remain disconnected from fundamentals. Aside from the negative implications for economic growth, higher interest rates also make equities less attractive when compared to other asset classes.

Our outlook for the global macroeconomic environment remained the same in recent weeks: We had already downgraded our assessment of this vector at the end of Q3. However, the decline in equity markets improved our assessment for both the valuation and sentiment vectors.

But before calling it a true correction, we would like to see increased volatility across most asset classes. A large part of the excesses that have been building up within financial markets over the last decade needs to be removed in order to create the market environment we are looking for to change our defensive positioning.

Returns presented are those of the MSCI net indexes in local currencies. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indexes or any securities or financial products. This report is not approved, reviewed or produced by MSCI.

References to specific companies and securities do not constitute a recommendation to buy, sell, or hold such securities, nor an indication that Hexavest or its affiliates have recommended such securities for any client account. The operating performance of the FANGs is shown for illustrative purposes only. Past performance is no guarantee of future results.

The information included in this article is presented for illustrative and discussion purposes only. It is meant to provide an example of Hexavest’s investment management capabilities and should not be construed as investment advice or as a recommendation to purchase or sell securities or to adopt any investment strategy. Any investment views and market opinions expressed are subject to change at any time without notice. This document should not be construed or used as a solicitation or offering of units of any fund or other security in any jurisdiction.

The opinions expressed in this article represent the current, good faith views of Hexavest at the time of publication and are provided for limited purposes, are not definitive investment advice, and should not be relied on as such. The information presented herein has been developed internally and/or obtained from sources believed to be reliable; however, Hexavest does not guarantee the accuracy, adequacy, or completeness of such information. Predictions, opinions, and other information contained herein are subject to change continually and without notice and may no longer be true after the date indicated. Hexavest disclaims responsibility for updating such views, analyses or other information. Different views may be expressed based on different investment styles, objectives, opinions or philosophies. It should not be assumed that any investments in securities, companies, countries, sectors or markets described were or will be profitable. It should not be assumed that any investor will have an investment experience similar to any portfolio characteristics or returns shown. This material may contain statements that are not historical facts (i.e., forward-looking statements). Any forward-looking statements speak only as of the date they are made, and Hexavest assumes no duty to and does not undertake to update forward-looking statements. Forward-looking statements are subject to numerous assumptions, risks, and uncertainties, which change over time. Future results may differ significantly from those stated in forward-looking statements, depending on factors such as changes in securities or financial markets or general economic conditions. Not all of Hexavest’s recommendations have been or will be profitable.