Will the Chinese government be the hurdle that slows markets?

August 5, 2021

The National Bureau of Economic Research (NBER) closed the books on the most recent recession and concluded it lasted 2 months, from February to April 2020. Although it was one of the deepest economic corrections in US history, it was also the shortest1.

Since then, the global economy has recovered slowly and the latest real GDP figures for the second quarter showed that the US economy is back to its pre-COVID levels2 thanks to supportive accommodative fiscal and monetary policy. However, inflation has risen considerably recently, especially in the US where the annual core inflation rose 4.5% in June3. This is the largest gain since the early 1990’s. Despite fast rising prices, the US Federal Reserve remains steadfast that accommodative monetary conditions are still warranted despite acknowledging the economy’s continued progress. The European central bank echoed a similar message suggesting that monetary conditions would remain very accommodative beyond the end of the COVID-19 crisis.

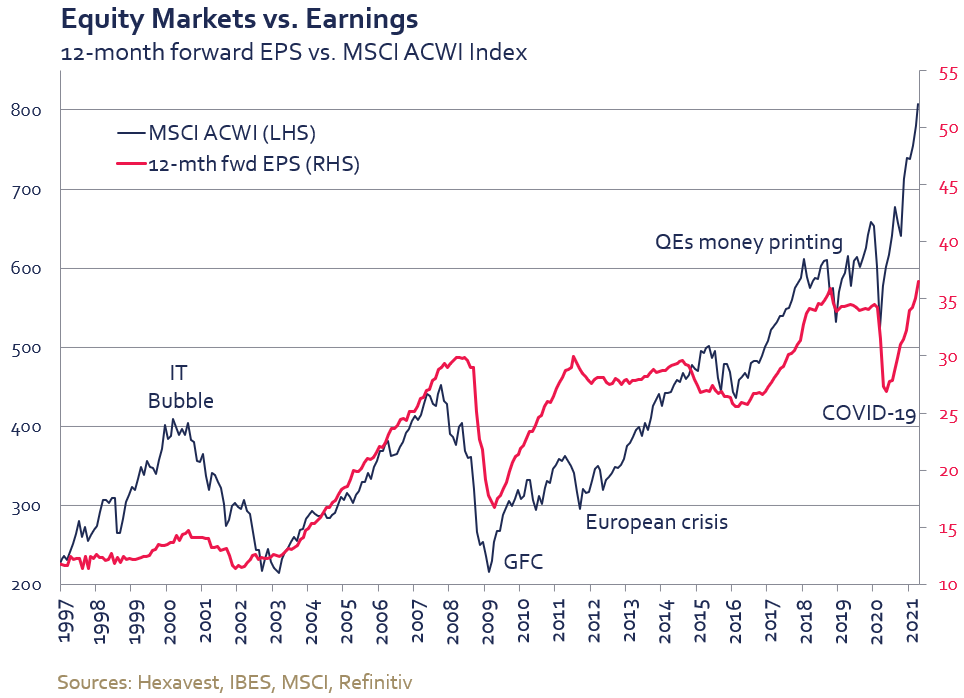

While the level of activity remains upbeat, there is a growing list of indicators suggesting the peak in growth is already behind us. This is a key risk for equity markets as stock prices reflect elevated investor expectations and have decoupled from fundamentals. For global equities, the gap between equity prices and earnings has widened over the last 12 months amid ample liquidity thanks, in part, to central banks’ extremely accommodative monetary policy. The likelihood of declining equity markets increases as growth decelerates in the coming quarters and investors reconsider the appropriateness of high valuation multiples.

One area of concern has been China where the government implemented measures that spooked investors. Beijing seems to be pro-actively tightening its grip on some industries to limit social inequalities. Other areas of focus were data security issues and the potentially monopolistic powers of some of the country’s largest companies. This last point has also been an issue in Western countries in recent years with several regulators considering options to reverse or break the current balance of power when companies dominate the marketplace.

After the last-minute suspension of Ant Group’s IPO by Chinese financial authorities in November 2020, we have noted a few crackdowns focusing on various sectors over the last few months. For example, technology and internet platforms are now seeing increased monitoring of their anti-competitive practices and are dealing with tighter security related to the use of their client’s personal data. Headlines were made when, only a few days after its controversial IPO in the US, ride hailing company Didi was punished by the Chinese authorities for having disregarded the government’s warnings related to its clients’ data security. During the last days of July, it was the education sector’s turn to feel the heat. With the objective of reducing education costs for families, Beijing instituted new rules forbidding private tutoring companies from making a profit from teaching core school subjects. Needless to say, those stocks plummeted on the news. Although these measures targeted specific companies, they raised concerns that other areas of the Chinese economy might be earmarked to endure taxing fundamental changes, thus contributing to the recent drawdown in the Chinese equity market.

Market performance

A rapid increase in the number of COVID-19 infections in the United Kingdom, before spreading to other countries, created some uneasiness in the investment community. The risk-off environment was short-lived and equity markets continued to climb higher. The MSCI World All-Country (ACWI) index recorded a sixth consecutive monthly gain (0.7%) in local currencies, bringing the year-to-date return to 14.2%. North America was the best performing region as US equities advanced 2.4%. Europe (1.5%) followed at a distance, while the Pacific region slid 1.6% The political and macro developments in China weighed on investors’ appetite for the emerging markets region. As a result, Chinese equities recorded a 13.8% drop, bringing the MSCI Emerging markets index down 6.1% for the month.

Long-term interest rates continued to move lower as central bankers in the US and the eurozone maintained a dovish stance despite an improving macro environment. The US 10-year treasury yield ended the month at 1.24%, declining 21 basis points in July. Materials (+3.0%) led the index higher, as gold ended up 3.3% and industrial metals finished higher. Sectors that are sensitive to lower interest rates fared well last month: IT (+2.8%), health care (+2.8%), utilities (+2.7%) and real estate (+1.6%) all outperformed. In contrast, energy producers suffered due to a pronounced fall in the price of crude oil earlier and ended the month down by 5.7%

Conclusion

Lofty growth expectations imply a relatively low bar for disappointment, and despite expected robust growth figures, the most recent earnings season may have left some investors disappointed. Given the stretched valuation, we believe the downside risks are significant and as such, we remain prudent in our positioning.

We welcome any questions or comments you may have. We can be reached at service@hexavest.com.

- https://www.washingtonpost.com/business/2021/07/29/gdp-q2-economy-covid-delta-recovery/

- https://www.cnbc.com/2021/07/29/the-us-economy-is-bigger-than-it-was-pre-pandemic-but-covid-could-still-decide-what-happens-next.html

- https://www.bloomberg.com/news/articles/2021-07-13/u-s-consumer-prices-increased-in-june-by-more-than-forecast?

Important Information and Disclosure

Source of all data and information: Hexavest and MSCI as at July 31, 2021, unless otherwise specified.

This material is presented for information and illustrative purposes only. The opinions expressed in this document represent the current, good-faith views of Hexavest at the time of publication and are provided for limited purposes, are not definitive investment advice, and should not be relied on as such. The information presented herein has been developed internally and/or obtained from sources believed to be reliable; however, Hexavest does not guarantee the accuracy, adequacy, or completeness of such information. Predictions, opinions, and other information contained herein are subject to change continually and without notice and may no longer be true after the date indicated. Hexavest disclaims responsibility for updating such views, analyses or other information. Different views may be expressed based on different investment styles, objectives, opinions or philosophies.

The MSCI ACWI Index is a broad-based securities market index and used for illustrative purposes only. The MSCI ACWI Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets. Performance for the MSCI ACWI Index is shown “net”, which includes dividend reinvestments after deduction of foreign withholding tax. Broad-based securities indices are unmanaged and are not subject to fees and expenses typically associated with managed accounts or investment It is not possible to invest directly in an index. MSCI data may not be reproduced or used for any other purpose. MSCI provides no warranties, has not prepared or approved this document, and has no liability hereunder.

Past performance does not predict future results. This material may contain statements that are not historical facts (i.e., forward-looking statements). Any forward-looking statements speak only as of the date they are made, and Hexavest assumes no duty to and does not undertake to update forward-looking statements. Forward-looking statements are subject to numerous assumptions, risks, and uncertainties, which change over time. Future results may differ significantly from those stated in forward-looking statements, depending on factors such as changes in securities or financial markets or general economic conditions. Not all Hexavest’s recommendations have been or will be profitable. Investing entails risks and there can be no assurance that Hexavest will achieve profits or avoid incurring losses. It should not be assumed that any investor will have an investment experience similar to returns shown.

This material is for the benefit of persons whom Hexavest reasonably believes it is permitted to communicate to and should not be reproduced, distributed or forwarded to any other person without the written consent of Hexavest.