Where to look for opportunities outside U.S. equities

February 26, 2019

With the U.S. market trading at decade-high premiums relative to international and emerging equities, and since the S&P 500’s earnings lead appears to be vanishing, we believe other regions are ripe to take on leadership. Here are two good reasons why.

U.S. earnings lead is reversing

U.S. equities ruled over the rest of the world for most of 2018, with the domination fueled by a significant profit lead for American corporations. MSCI U.S. EPS growth tallied north of 20% in 2018, double the rate for EAFE and emerging markets. Consequently, this profit domination has lifted the MSCI U.S. premium to 25% over the World ex-U.S. based on forward P/E multiples*. Still, the U.S. index performance advantage faded somewhat in the fourth quarter as signs of slowing domestic momentum erupted through weaker auto and housing activity. U.S. retail sales also ended 2018 with significant weakness in December, which is somewhat of a surprise considering still buoyant employment conditions and declining gasoline prices. More recently, earnings revisions have turned negative across the world, and the U.S. has been following this downward trend, as highlighted in the following chart. We believe sustaining price leadership will be challenging for U.S. equities, as premium valuations will have to answer to a weakening earnings outlook.

The China angle

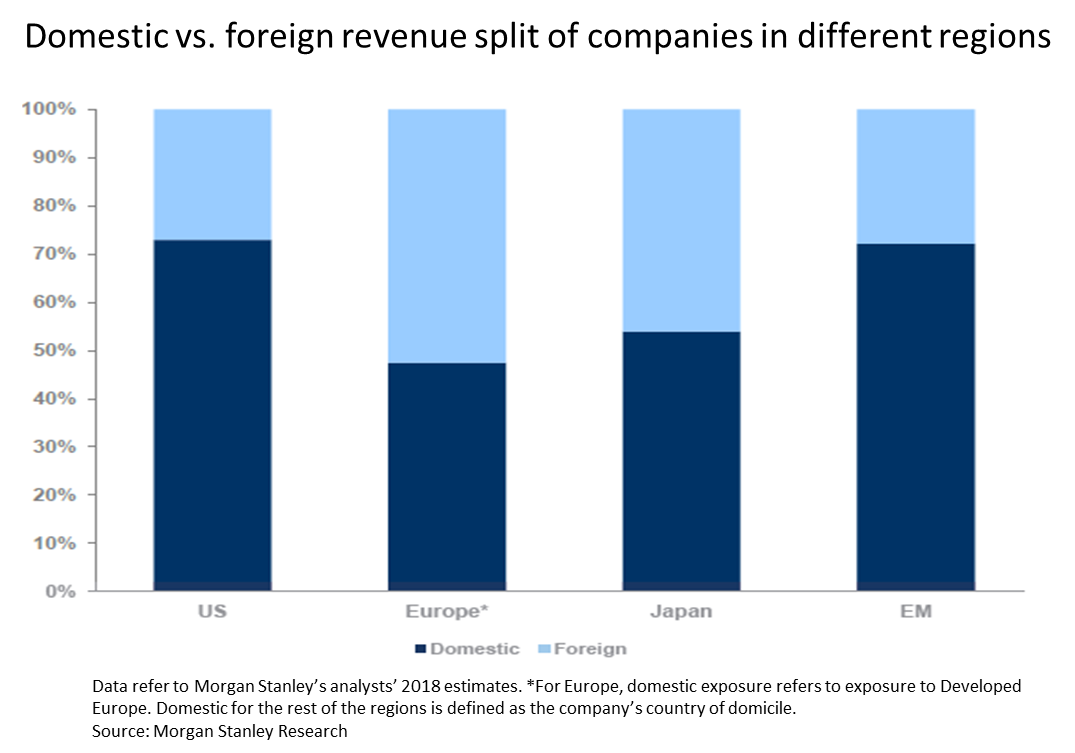

Chinese crosscurrents (U.S.–China trade war domestic slowdown) were notable headwinds for risk assets** in 2018, lending even more shine to the U.S. exceptionalism story. Global trade was challenged by slowing Chinese demand, and both German and Japanese industrial production were among the key casualties. Hence, the macro highlight of 2018 was how the U.S. economy resisted the global slowdown, but 2019 could see a reversal of fortunes, as the U.S. economy is now showing faltering signs. Our macro view for China in 2019 is that the slowdown could trough by midyear with a pickup expected in the second half, a scenario supported by the rising possibility of a trade agreement with the U.S. and additional government stimulus. Improving macro visibility in China could also provide a tail wind for companies outside the U.S. who benefit the most from global trade. The graph below illustrates the domestic bias of U.S. companies’ revenues exposure with Europe and Japan taking a large share of foreign revenues.

Since Chinese equities and emerging markets have apparently priced in the negative news flow related to the trade tensions, our view is that the risk-reward outlook for emerging markets, Chinese equities and Japan is superior to the U.S. As for Europe, the geopolitical uncertainties in France (gilets jaunes) and the U.K. (Brexit) are negative factors we take into account in our macroeconomic analysis. This being said, we believe Europe provides a better alternative than the U.S. as European companies seem more likely to benefit from a pickup of the Chinese economy in 2019.

*Sources: IBES, MSCI, Datastream, December 31, 2018.

** Equities, commodities, corporate bonds, emerging market bonds, emerging market currencies, and commodity currencies.

Photo by Bru-nO on Pixabay

NOTES: The information included in this document is presented for illustrative and discussion purposes only. It is meant to provide an example of Hexavest’s investment management capabilities and should not be construed as investment advice or as a recommendation to purchase or sell securities or to adopt any investment strategy. Any investment views and market opinions expressed are subject to change at any time without notice. This document should not be construed or used as a solicitation or offering of units of any fund or other security in any jurisdiction.

The opinions expressed in this document represent the current, good-faith views of Hexavest at the time of publication and are provided for limited purposes, are not definitive investment advice, and should not be relied on as such. The information presented herein has been developed internally and/or obtained from sources believed to be reliable; however, Hexavest does not guarantee the accuracy, adequacy, or completeness of such information. Predictions, opinions, and other information contained herein are subject to change continually and without notice and may no longer be true after the date indicated. Hexavest disclaims responsibility for updating such views, analyses or other information. Different views may be expressed based on different investment styles, objectives, opinions or philosophies. It should not be assumed that any investments in securities, companies, countries, sectors or markets described were or will be profitable. It should not be assumed that any investor will have an investment experience similar to any portfolio characteristics or returns shown. This material may contain statements that are not historical facts (i.e., forward-looking statements). Any forward-looking statements speak only as of the date they are made, and Hexavest assumes no duty to and does not undertake to update forward-looking statements. Forward-looking statements are subject to numerous assumptions, risks, and uncertainties, which change over time. Future results may differ significantly from those stated in forward-looking statements, depending on factors such as changes in securities or financial markets or general economic conditions. Not all of Hexavest’s recommendations have been or will be profitable.

No part of this document may be reproduced or distributed in any manner without the prior written permission of Hexavest