Trade fears weigh on investor sentiment, U.S. leadership at crossroads

September 9, 2019

Vital Proulx

The escalation of the U.S.-China trade dispute has further dampened global manufacturing activity through the summer months, sending the world manufacturing PMI index near its lowest level since 2016. The following is a brief update of the market outlook by our co-CIOs.

Equities and risk assets enjoyed a strong rally in the first half of 2019 as investor optimism was driven by hopes of a quick resolution to the U.S.-China trade dispute. But as uncertainty lingers on, the MSCI ACWI index has pulled back 3% from its July high while copper has declined over 15% since April. Still, U.S. equity leadership has remained a key fixture so far this year amidst weaker-than-expected European and Asian macroeconomic fundamentals. However, the most recent U.S. manufacturing statistics seem to point to a pending shift as the rest of the world appears closer to a bottom.

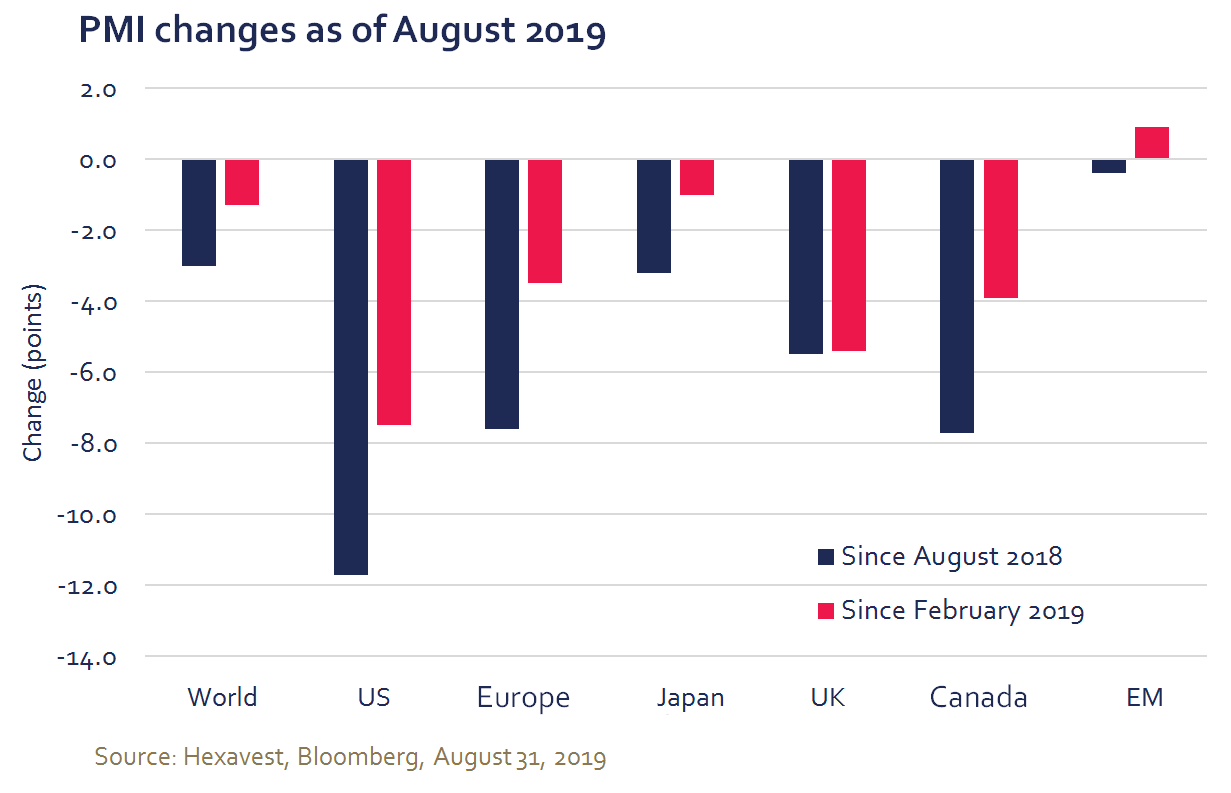

As highlighted in the chart below, the U.S. economy is now sporting the worst trend in PMI manufacturing surveys on a six-month and year-over-year basis. With manufacturing confidence waning, the outlook for U.S. profits and business spending should remain clouded in coming months, which, in turn, should most likely lead to more tame GDP growth.

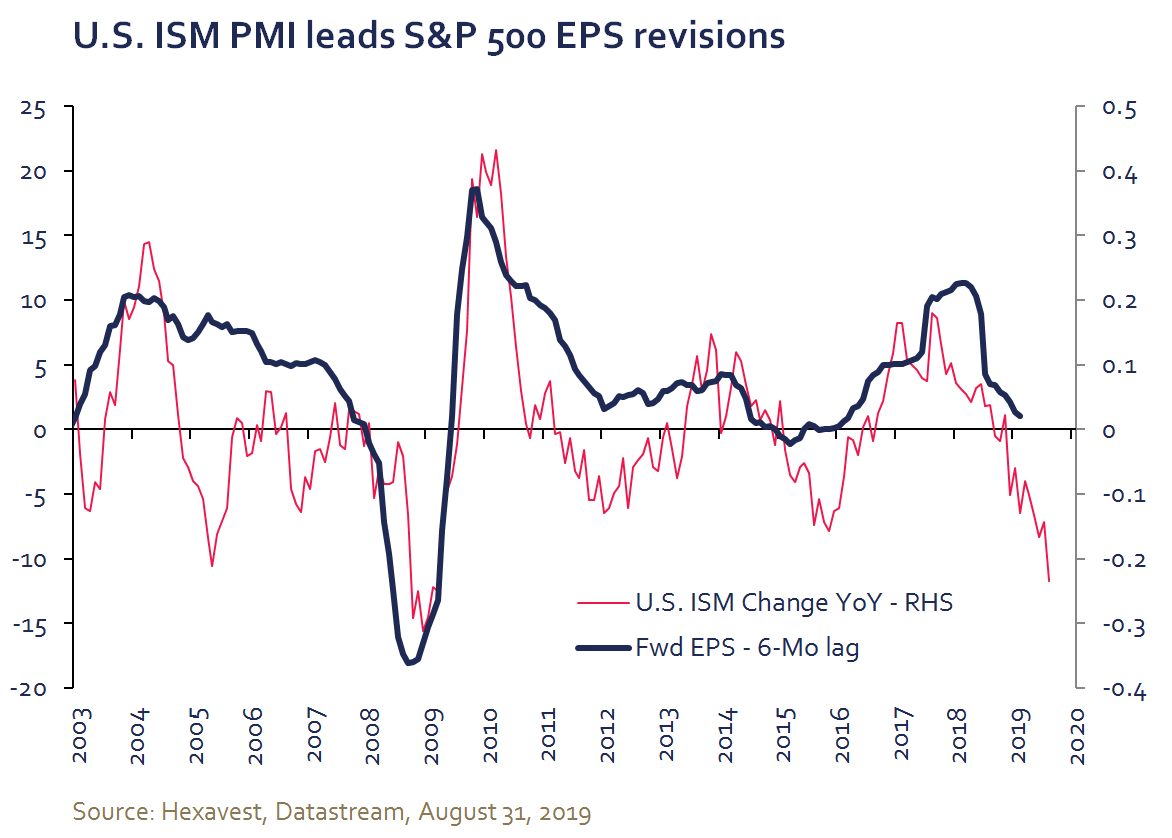

Since changes in earnings leadership usually set the stage for a shift in performance leadership, we believe the U.S. equity domination will be hard to sustain as S&P 500 forward earnings estimates will potentially follow the ISM PMI’s lead in coming months.

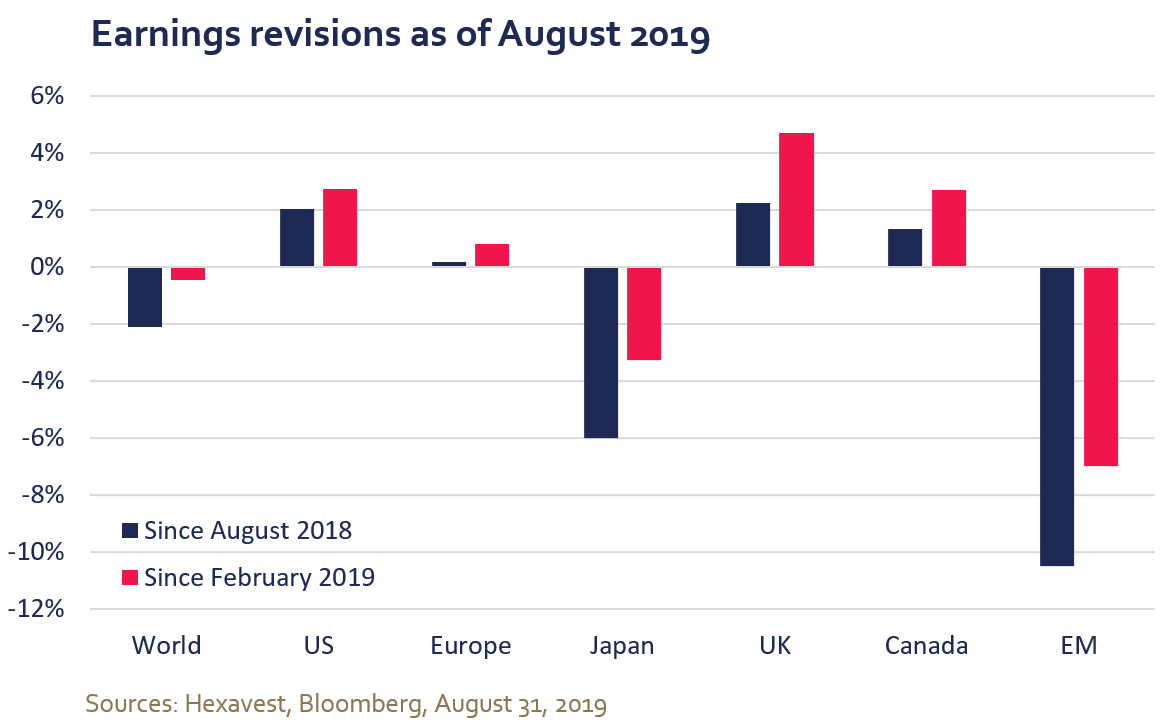

As shown in the graph below, earnings revisions for the U.S. have easily outpaced Europe, Japan, and emerging markets in the last 12 months.

We expect this trend will reverse in light of challenges weighing on corporate America heading into 2020.

Although premium S&P 500 valuations have been a long-lasting source of discomfort for us, the risk of macro and earnings disappointment are the pillars of our significant U.S. underweight position (for equities and currency).

One of the key convictions in our global equity portfolios has been the pending reversal in U.S. equity leadership. Portfolio positioning is indeed defensive, but the game plan to gradually add cyclicals remains intact and has partially been implemented. The important decline in bond yields is not lost on us, and we have been gradually reducing exposure to “bond proxies”. When our assessment of our macroeconomic vector improves, our objective will be to further take advantage of opportunities where valuation and sentiment are looking increasingly attractive, i.e. value cyclical sectors such as financials, resources and industrials. The contrarian trade is taking us towards sectors that have been overlooked in recent years, and we believe we can take advantage of further market volatility to raise exposure to the value style in coming months.

NOTES

Source of all data and information: Hexavest as at August 31, 2019, unless otherwise specified.

The returns of the MSCI indices are presented net of deductions from foreign withholding taxes.

MSCI data presented may not be reproduced or used for any other purpose. MSCI provides no warranties, has not prepared or approved this report, and have no liability hereunder. Past performance does not predict future results.

This material is presented for informational and illustrative purposes only. It is meant to provide an example of Hexavest’s investment management capabilities and should not be construed as investment advice or as a recommendation to purchase or sell securities or to adopt any particular investment strategy. Any investment views and market opinions expressed are subject to change at any time without notice. This document should not be construed or used as a solicitation or offering of units of any fund or other security in any jurisdiction.

The opinions expressed in this document represent the current, good-faith views of Hexavest at the time of publication and are provided for limited purposes, are not definitive investment advice, and should not be relied on as such. The information presented herein has been developed internally and/or obtained from sources believed to be reliable; however, Hexavest does not guarantee the accuracy, adequacy, or completeness of such information. Predictions, opinions, and other information contained herein are subject to change continually and without notice and may no longer be true after the date indicated. Hexavest disclaims responsibility for updating such views, analyses or other information. Different views may be expressed based on different investment styles, objectives, opinions or philosophies. It should not be assumed that any investments in securities, companies, countries, sectors or markets described were or will be profitable. It should not be assumed that any investor will have an investment experience similar to any portfolio characteristics or returns shown. This material may contain statements that are not historical facts (i.e., forward-looking statements). Any forward-looking statements speak only as of the date they are made, and Hexavest assumes no duty to and does not undertake to update forward-looking statements. Forward-looking statements are subject to numerous assumptions, risks, and uncertainties, which change over time. Future results may differ significantly from those stated in forward-looking statements, depending on factors such as changes in securities or financial markets or general economic conditions. Not all of Hexavest’s recommendations have been or will be profitable.

This material is for the benefit of persons whom Hexavest reasonably believes it is permitted to communicate to and should not be reproduced, distributed or forwarded to any other person without the written consent of Hexavest. It is not addressed to any other person and may not be used by them for any purpose whatsoever. It expresses no views as to the suitability of the investments described herein to the individual circumstances of any recipient or otherwise.