Exogenous shocks and economic growth

Overview of the COVID-19 and oil war issues

March 18, 2020

Jean-Pierre Couture

An exogenous shock comes from outside the economic system and may take the form of a supply shock or a demand shock. Two shocks of this kind have occurred in the first quarter of 2020: 1) the COVID-19 pandemic; and 2) the oil price war. Our Chief Economist explains the situation and provides a summary of his analysis.

COVID-19 and the oil war: two exogenous shocks with multiple repercussions

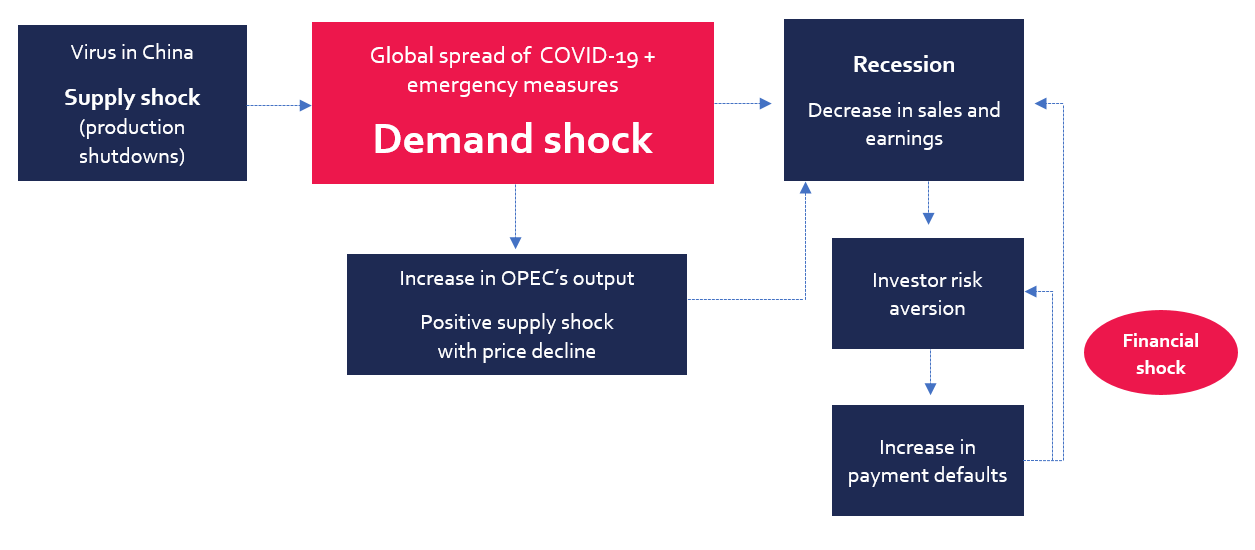

Even though the exogenous shock of COVID-19 was originally a supply shock that occurred in China, it rapidly became a global demand shock affecting household demand (consumer spending), followed by business demand (delay or postponement of investment).

- Consumption of services is likely to be hit hardest (travel, leisure, restaurants, etc.), but all types of expenses will be affected if the labour market deteriorates and household income falls.

- Corporate investment will most probably be affected by production and delivery delays, as well as by lower demand and an increasingly uncertain growth outlook.

Saudi Arabia has responded to Russia’s decision not to co-operate on oil-supply management by increasing its output. In addition to the global demand shock caused by COVID-19, we therefore have a related supply shock. The effects of the combined shocks will vary across the different sectors of the economy:

- The decline in oil prices is expected to be positive for oil importing countries, but negative for producing countries, such as the United States.

- The positive effect of the price drop on household spending will be modest, given COVID-19’s impact on consumer habits and travel.

The macroeconomic impact of these shocks is very difficult to assess. In the case of COVID-19, the impact will depend on the extent of the preventive measures imposed by governments and the persistence of the fear factor on the part of consumers. The duration of the crisis will also be decisive.

As for the oil price weakness, how long it lasts will obviously depend on the negative impact of the virus on global economic activity and oil demand, but also on the ability of OPEC and Russia to stick to their positions. They could come to an agreement quickly or they could embark on a costly war of attrition.

The authorities’ response: varied measures on two fronts

So far governments have acted on two fronts by:

- trying to slow the spread of the virus; and

- announcing emergency measures to support the economy.

The preventive measures aimed at slowing the spread of the virus (quarantines, cancellation of events, travel restrictions, health advisories, etc.) have led to an immediate decline in economic activity that cannot be offset by emergency budgetary and monetary measures. Even so, the economic stimulus measures announced seem to help reassure the public and investors. And they should also contribute to a resumption of growth once the crisis is over. The more stringent the containment and prevention measures, the quicker they will allow the stimulus to take effect and the economy to get back on track. But the laxer the response by governments and individuals, the worse the macroeconomic impact will likely be.

The central banks have also taken action to reassure the financial markets and to provide the necessary liquidity in these times of major financial stress. Given the current exogenous shocks, conventional monetary actions are likely to have little direct effect on economic activity. In our view, the current role of central banks is to limit cascading reactions on the financial markets, which could worsen the economic situation. Their measures have been more targeted, with the goal of ensuring the banking system and the credit market function smoothly. To that end, they are providing advantageous financing to banks if they make loans, injecting massive amounts of liquidity into the money markets, easing banks' capital rules and reserve requirements, etc.

Our two main scenarios

At the time of writing, two scenarios are emerging. The first scenario calls for a short-term “mechanical” contraction of the economy, followed by a recovery after the COVID-19 crisis. The recovery will be due primarily to a “mechanical” rebound in activity after things return to normal, but it will also get a boost from the stimulus measures adopted by governments and central banks.

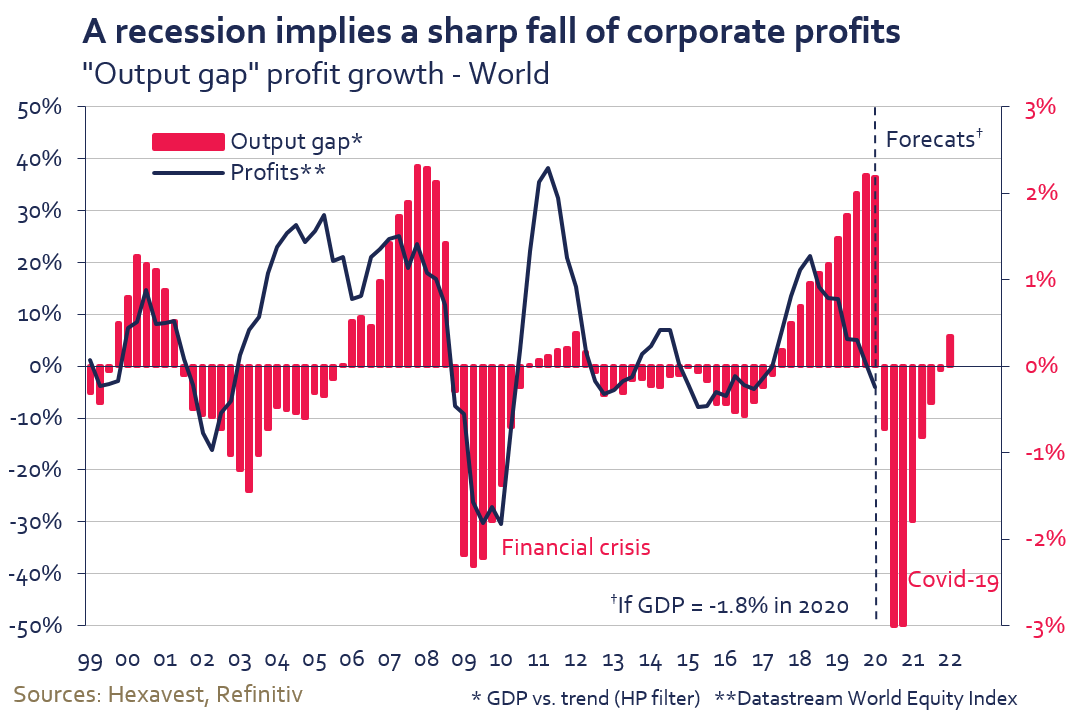

The second scenario is more worrisome. In our view, the greatest risk to global activity is significant disruption in the corporate debt market owing to the combined effect of the economic downturn and risk aversion on the part of investors. The global demand shock coming after China’s supply shock would be amplified by a financial shock.

The debt ratios of U.S., Chinese and European companies have reached record levels. If the credit spigots close, a wave of defaults in the corporate debt market could further weaken the economy and the stock markets. The state of the corporate bond market therefore calls for close monitoring.

Macro vector downgrade

With these two exogenous shocks occurring in rapid succession, we have decided to modify our outlook for the “macroeconomic environment” vector. The extraordinary change in conditions has prompted us to adjust our analysis.

We will reassess the situation, but for the next few months, our portfolio construction will be based on a more difficult macroeconomic outlook.

Source of all data and information: Hexavest as at March 17, 2020, unless otherwise specified.

This material is presented for informational and illustrative purposes only. It is meant to provide an example of Hexavest’s investment management capabilities and should not be construed as investment advice or as a recommendation to purchase or sell securities or to adopt any particular investment strategy. Any investment views and market opinions expressed are subject to change at any time without notice. This document should not be construed or used as a solicitation or offering of units of any fund or other security in any jurisdiction.

The opinions expressed in this document represent the current, good-faith views of Hexavest at the time of publication and are provided for limited purposes, are not definitive investment advice, and should not be relied on as such. The information presented herein has been developed internally and/or obtained from sources believed to be reliable; however, Hexavest does not guarantee the accuracy, adequacy, or completeness of such information. Predictions, opinions, and other information contained herein are subject to change continually and without notice and may no longer be true after the date indicated. Hexavest disclaims responsibility for updating such views, analyses or other information. Different views may be expressed based on different investment styles, objectives, opinions or philosophies. It should not be assumed that any investments in securities, companies, countries, sectors or markets described were or will be profitable. It should not be assumed that any investor will have an investment experience similar to any portfolio characteristics or returns shown. This material may contain statements that are not historical facts (i.e., forward-looking statements). Any forward-looking statements speak only as of the date they are made, and Hexavest assumes no duty to and does not undertake to update forward-looking statements. Forward-looking statements are subject to numerous assumptions, risks, and uncertainties, which change over time. Future results may differ significantly from those stated in forward-looking statements, depending on factors such as changes in securities or financial markets or general economic conditions. Not all of Hexavest’s recommendations have been or will be profitable.

This material is for the benefit of persons whom Hexavest reasonably believes it is permitted to communicate to and should not be reproduced, distributed or forwarded to any other person without the written consent of Hexavest. It is not addressed to any other person and may not be used by them for any purpose whatsoever. It expresses no views as to the suitability of the investments described herein to the individual circumstances of any recipient or otherwise.