Emerging-markets equities: Is it time to buy yet?

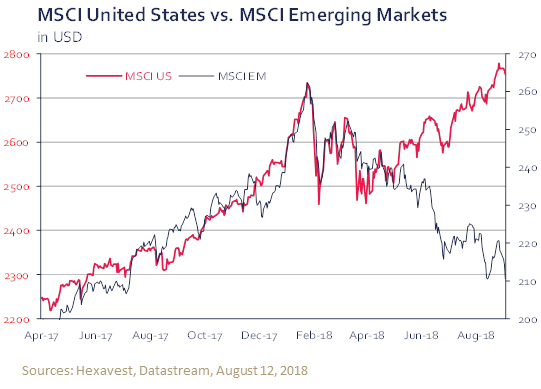

After posting exceptional returns in 2017 and in January 2018, emerging markets have since corrected by 11%. Is the pullback sufficient to increase exposure to this asset class? Our chief economist, who is also a member of the emerging markets team, shares his insights.

September 24, 2018

Jean-Pierre Couture

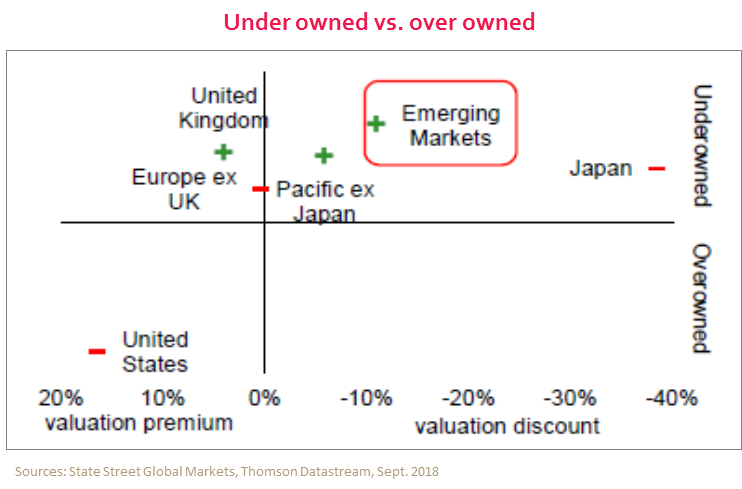

Most of our valuation and contrarian sentiment indicators are currently pointing to an overweight positioning in emerging-markets (EM) equities. In our view, EM equities are not expensive and have become under-owned. Still, the macroeconomic environment remains hostile in the short term for EM equities. Are the valuation and sentiment vectors positive enough to compensate for our concerns over the macroeconomic backdrop? Let’s look at each of the three vectors in detail.

Macro: Monitoring trade tensions amidst slowing economic growth

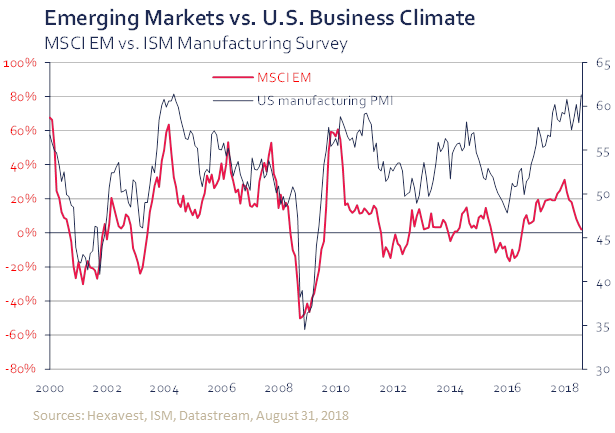

The 2017 global synchronized growth pattern has vanished in 2018, and all regions except the U.S. are now in a slower growth regime. Hexavest’s base case scenario is that the U.S. economy will also decelerate in coming quarters. We believe U.S. business climate surveys (PMIs) will probably be the first indicator to cool down. Most regional surveys are already trending down, but one of the most watched, the ISM survey, still stands at a cyclical high. At these elevated ISM levels (>60), the positive/negative surprises of economic news becomes asymmetric. Hence, we believe it is usually a good time to reduce broad exposure to risky assets.

The current U.S.-China trade tensions have many implications. For American companies, it reduces the visibility of their supply chain and their export markets. In order to grow, EM manufacturing and commodity-producing countries need trade to be fluid and strong; most EMs remain export-driven economies. There is anecdotal evidence suggesting that many U.S. companies have accelerated their orders last summer to avoid higher tariffs on Chinese goods, so we could see much more weakness in EM new orders and export volumes in the coming months.

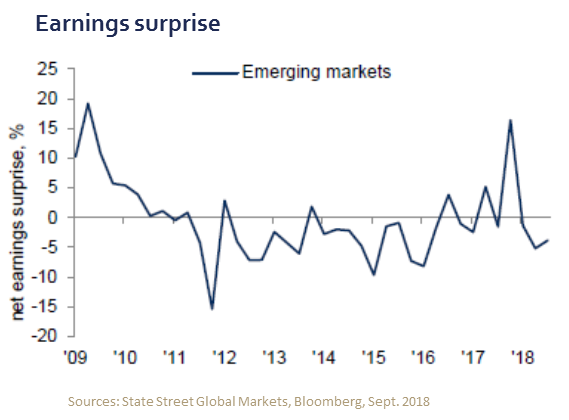

Heightened trade tensions are occurring at a time of an ongoing slowdown in China and cracks in the recoveries in Brazil, Russia, and South Africa. Growing imbalances in several countries (e.g. Turkey, Indonesia, and India) also need to be monitored. Bottom line: macro headwinds could translate into further negative revisions on forecasted GDP growth and expected earnings for EMs.

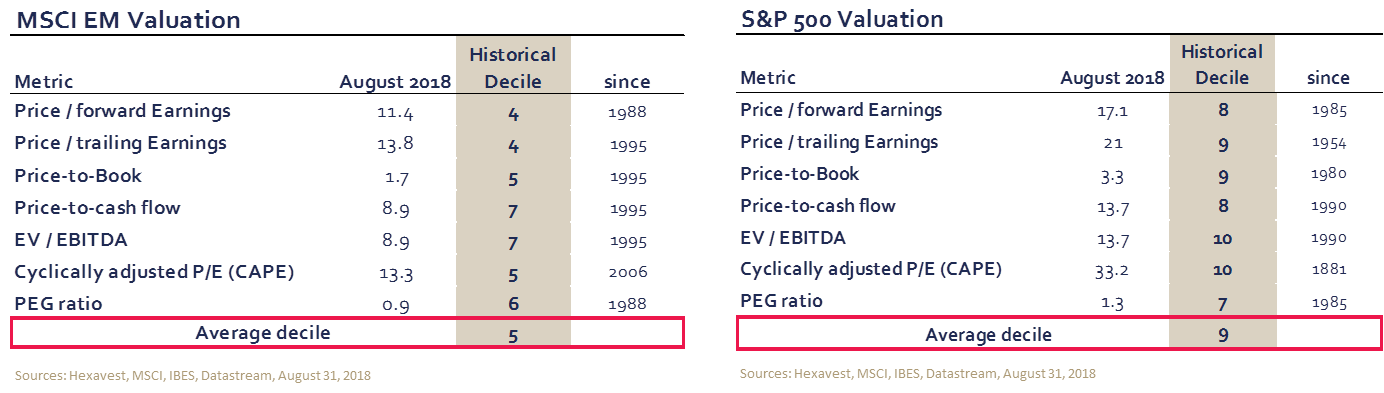

Valuation: An attractive entry point based on discount vs. U.S. equities

EM equities’ current valuation is well aligned with its historical norm. Hence, we believe long-term returns should be close to their historical standards (above 12% per year in total returns). In contrast, we are seeing the complete opposite in the U.S.: U.S. equities are extremely expensive, implying lackluster expected returns. At current valuation levels, the opportunity to increase EM exposure and reduce U.S. exposure can be very appealing to long-term investors.

Sentiment of investors: Risks and fears appear priced in

Trade tensions between China and the U.S. have been making headlines since the start of 2018, and negative sentiment is reflected in investor positioning with portfolios under-owning EM equities.

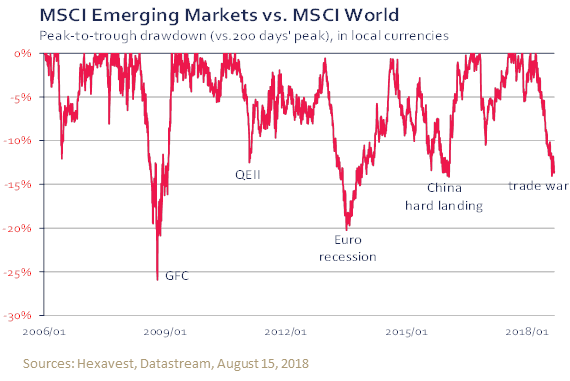

Moreover, the recent underperformance of EMs relative to developed markets is comparable to past correction cycles, especially when expressed in USD terms.

Finally, contagion fears from “weak countries” (Argentina, Turkey, South Africa, Indonesia) to other emerging countries have already negatively impacted currencies and the sovereign bond market.

Our game plan to increase EM exposure

As two of three vectors of analysis have turned positive, we feel more compelled to increase our exposure to emerging markets. Our assessment of the macroeconomic environment remains negative, but China appears ready for the next wave of stimuli to compensate for U.S. tariffs and more generally with the ongoing slowdown1. In our opinion, an increase in government spending and additional monetary easing could be enough to attract investors back in EM equities and commodities.

Still, a U.S. equity market correction, especially in sectors that have already suffered in emerging markets (technology and consumer discretionary), would bolster our confidence in increasing our exposure to EM equities. We consider EM equities as a “beta play” on global growth, and therefore we would prefer to wait until U.S. PMIs (business climate) weaken and recouple with the rest of the world. At that point, investors should have capitulated and the entry point could be even more appealing.

1- Source: NDRC’s press conference (19 SEPT 2018)

The information included in this article is presented for illustrative and discussion purposes only. It is meant to provide an example of Hexavest’s investment management capabilities and should not be construed as investment advice or as a recommendation to purchase or sell securities or to adopt any investment strategy. Any investment views and market opinions expressed are subject to change at any time without notice. This document should not be construed or used as a solicitation or offering of units of any fund or other security in any jurisdiction.

The opinions expressed in this article represent the current, good faith views of Hexavest at the time of publication and are provided for limited purposes, are not definitive investment advice, and should not be relied on as such. The information presented herein has been developed internally and/or obtained from sources believed to be reliable; however, Hexavest does not guarantee the accuracy, adequacy, or completeness of such information. Predictions, opinions, and other information contained herein are subject to change continually and without notice and may no longer be true after the date indicated. Hexavest disclaims responsibility for updating such views, analyses or other information. Different views may be expressed based on different investment styles, objectives, opinions or philosophies. It should not be assumed that any investments in securities, companies, countries, sectors or markets described were or will be profitable. It should not be assumed that any investor will have an investment experience similar to any portfolio characteristics or returns shown. There are no guarantees concerning the achievement of investment objectives, target returns, , growth trajectories, earnings projections, allocations or measurements such as alpha, tracking error, stock weightings and information ratios. This material may contain statements that are not historical facts (i.e., forward-looking statements). Any forward-looking statements speak only as of the date they are made, and Hexavest assumes no duty to and does not undertake to update forward-looking statements. Forward-looking statements are subject to numerous assumptions, risks, and uncertainties, which change over time. Future results may differ significantly from those stated in forward-looking statements, depending on factors such as changes in securities or financial markets or general economic conditions. Past performance does not predict future results. Not all of Hexavest’s recommendations have been or will be profitable.

No part of this document may be reproduced in any manner without the prior written permission of Hexavest