Coronavirus escalation and its impact on the economy and markets

March 6, 2020

Market volatility has risen sharply since the coronavirus (COVID-19) has been spreading in South Korea and in countries that had so far been relatively unaffected, such as Italy, Iran and Japan. Here is our quick read of the current and potential impacts of COVID-19 on the global economy and stock markets.

Investors panicked after initially showing little concern

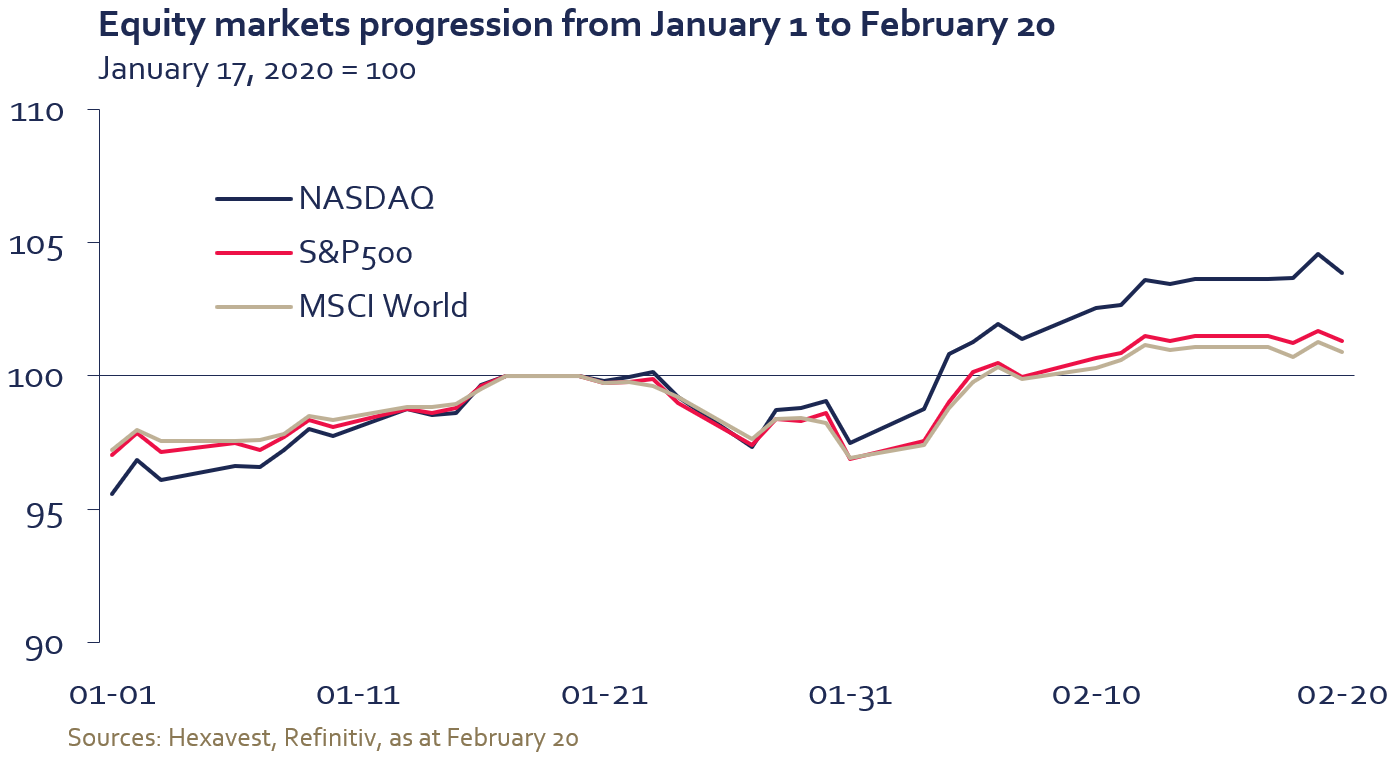

For several weeks after the COVID-19 outbreak, investors seemed little concerned about its potential effects, despite warnings from corporate bellwethers (IT, luxury goods and travel). Between the initial news of COVID-19 in mid-January and February 20, the U.S. stock markets even hit record high levels and the NASDAQ rallied more than 7%.

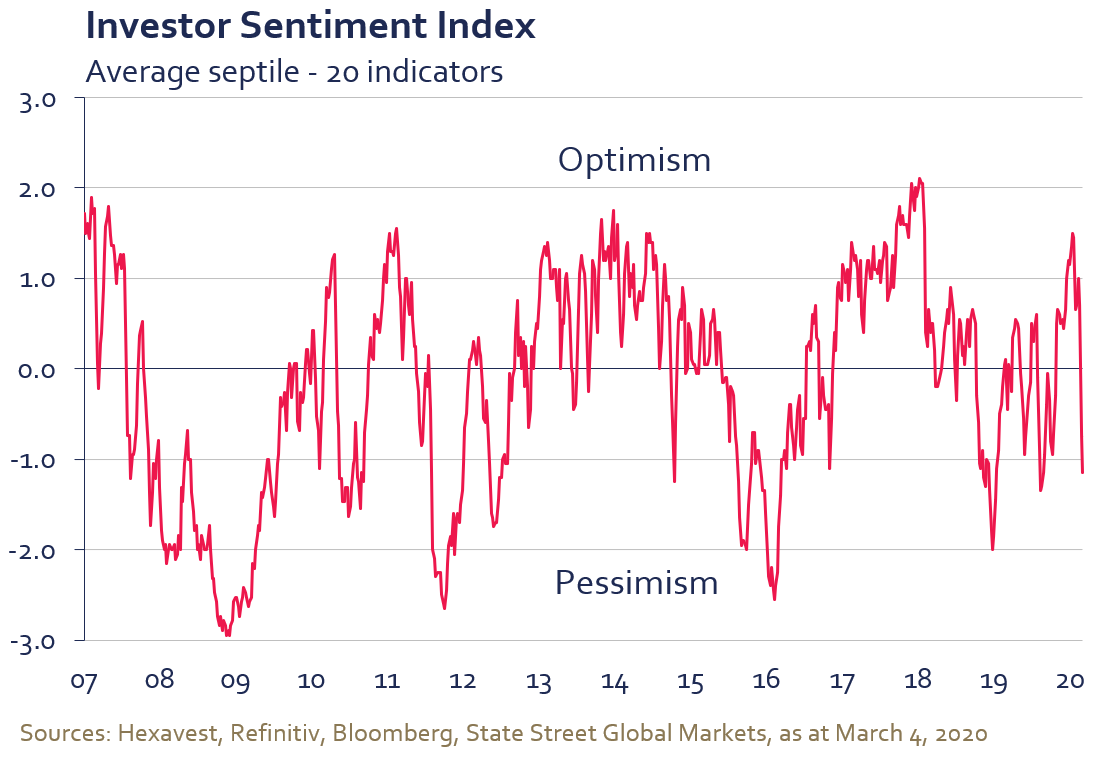

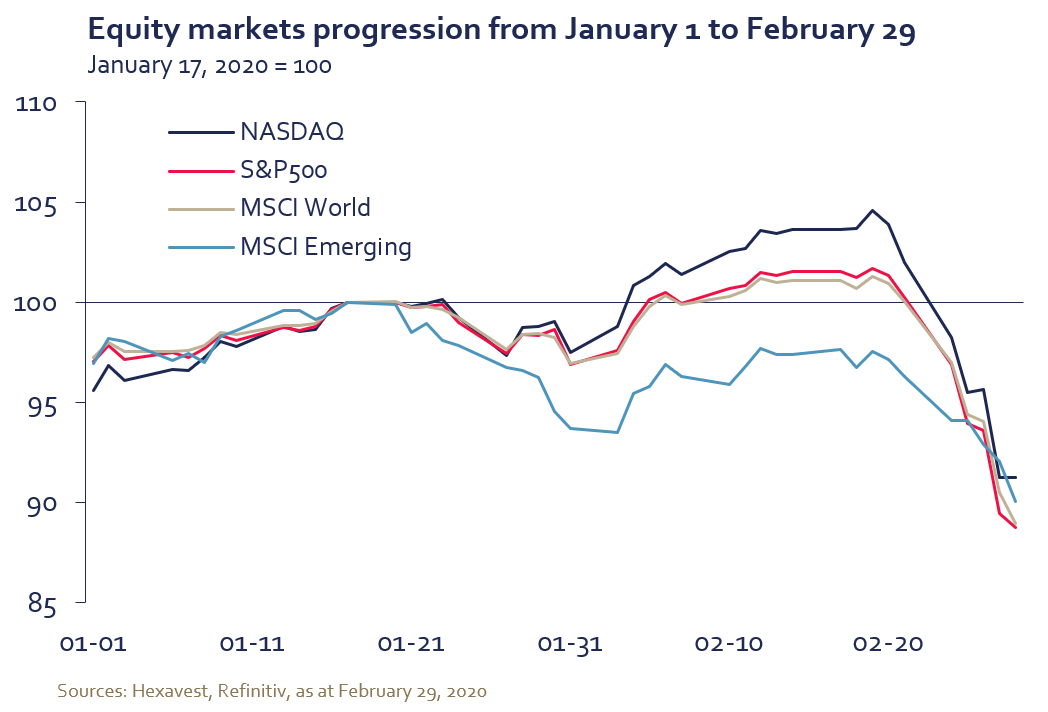

Yet, since February 21, global benchmarks have suffered a significant setback. Investor sentiment has taken a turn for the worse following last week’s sell-off. Our sentiment indicator has fallen back into pessimistic territory and is currently standing at its most depressed level on a six-month basis.

Also, since February 21, complacency in markets outside Asia has reversed. U.S. markets are now experiencing the weakness suffered by emerging markets during the first weeks of the COVID-19 outbreak in China. However, with the exception of emerging markets, all regions had peaked before the sell-off.

Finally, it should be noted that almost all sectors have declined equally. While the S&P 500 index retreated by 12.9% between February 21 and 28, 10 of the 11 sectors were down by 12% to 14%. Utilities (‑12.5%) and real estate (-13.0%), two defensive sectors, also suffered despite the decline in the U.S. 10‑year Treasury yields. Even gold stocks underperformed, falling 14%.

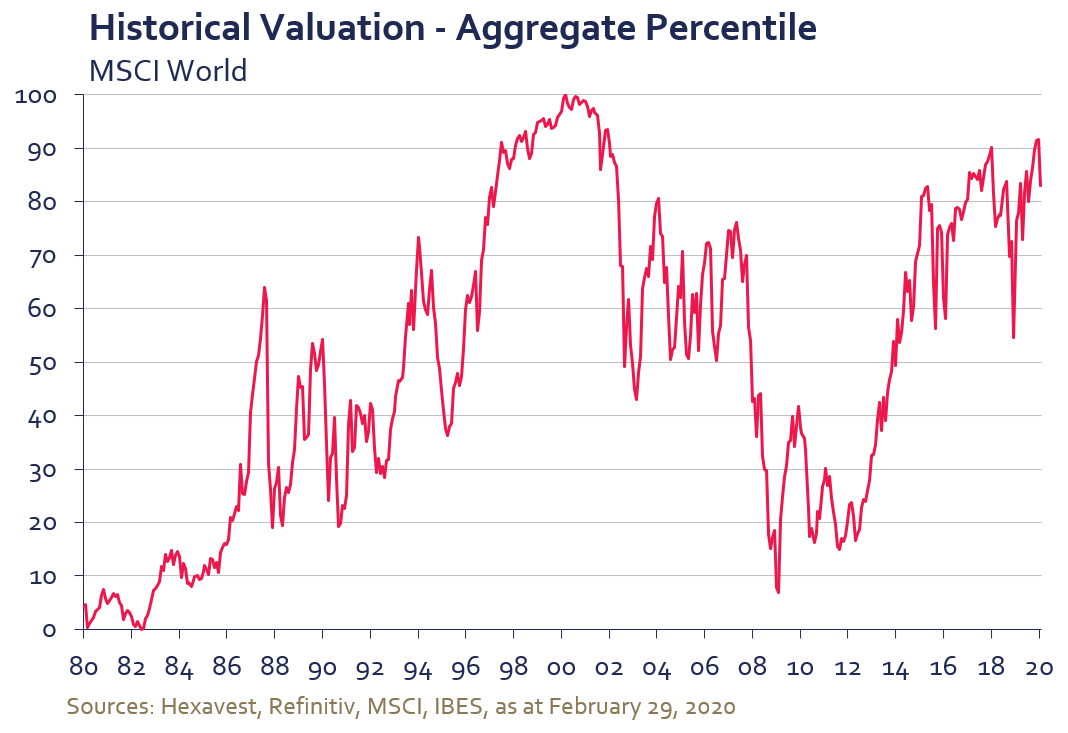

U.S. equities remain expensive despite the correction

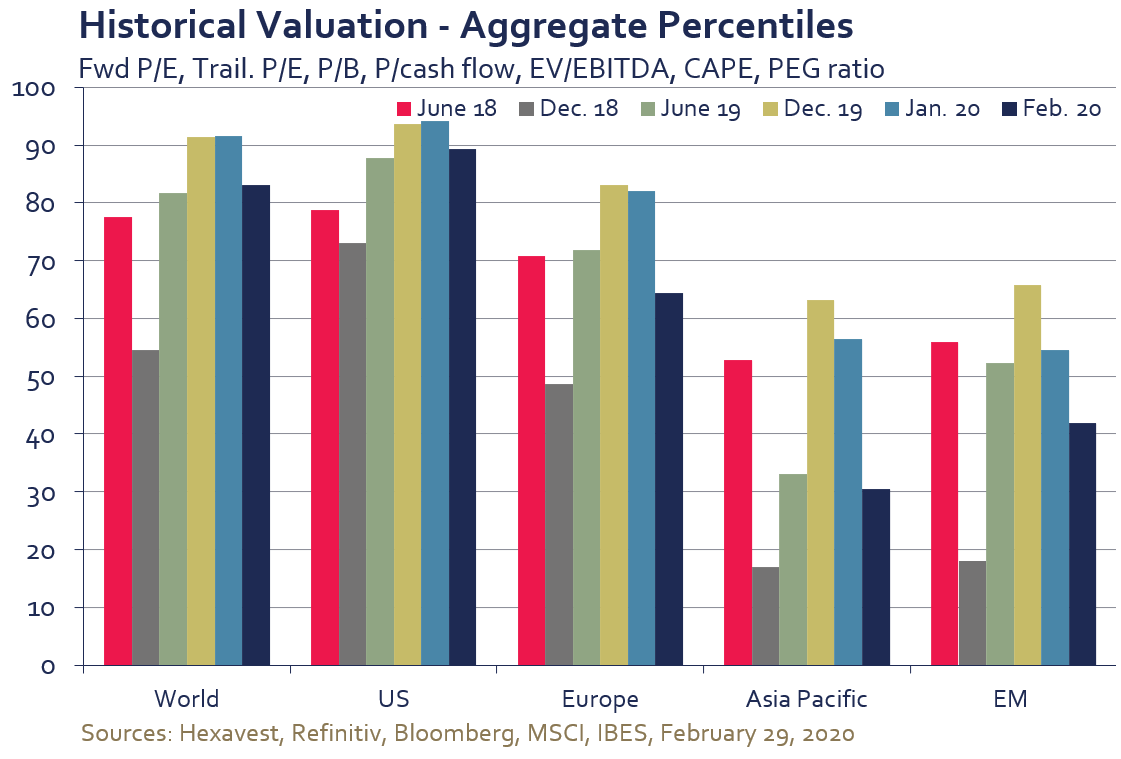

After reaching its highest valuation level in 19 years during the month of January, the MSCI World index reached the 83rd percentile of its historical distribution at the end of February. At the same time, the drop in sovereign yields has pushed valuation multiples of defensive sectors higher, rendering them less attractive in an environment of heightened uncertainty.

From a regional standpoint, the COVID-19 epidemic has had a greater impact on the valuation of Asian countries. The spread in valuations between developed Asia and emerging markets decreased significantly compared to the end of 2019. In the U.S., despite the recent market decline, our valuation indicator remained high and close to its 10th decile.

Governments and central banks to the rescue

Although it is difficult to assess the coronavirus’ full impact on the global economy, we believe that restrictions on movements of people and goods will disrupt the global supply chain and the travel industry. The impact, while hard to quantify, will most likely delay, rather than derail, the global economic recovery that started in late 2019. And the longer it takes to contain the virus, the worse its economic effect should be.

This being said, central banks and governments are increasingly concerned. We believe they will aim to mitigate the negative short-term economic impact by providing pre-emptive support, which should set the stage for a recovery when the panic subsides. Interestingly, equity indices in China and Hong Kong are holding up as the correction migrated to Europe and the U.S. Several fiscal and monetary measures have already been announced in Asia. The Federal Reserve followed this week, cutting its key rate by 50 basis points. Further easing is expected, thus capping greenback strength. All in all, we do not believe that the coronavirus will prevent further global growth, as fiscal and monetary support will quickly come to the rescue.

In our view, vigilance regarding the progression of COVID-19 is required. Our top-down approach allows us to assess the fact that the different regions are not all equal in the face of the current environment. We will reassess our macroeconomic outlook accordingly, while remaining on the lookout for valuation and sentiment opportunities.

Source of all data and information: Hexavest as at February 29, 2019, unless otherwise specified.

This material is presented for informational and illustrative purposes only. It is meant to provide an example of Hexavest’s investment management capabilities and should not be construed as investment advice or as a recommendation to purchase or sell securities or to adopt any particular investment strategy. Any investment views and market opinions expressed are subject to change at any time without notice. This document should not be construed or used as a solicitation or offering of units of any fund or other security in any jurisdiction. MSCI provides no warranties, has not prepared or approved this report, and have no liability hereunder.

The opinions expressed in this document represent the current, good-faith views of Hexavest at the time of publication and are provided for limited purposes, are not definitive investment advice, and should not be relied on as such. The information presented herein has been developed internally and/or obtained from sources believed to be reliable; however, Hexavest does not guarantee the accuracy, adequacy, or completeness of such information. Predictions, opinions, and other information contained herein are subject to change continually and without notice and may no longer be true after the date indicated. Hexavest disclaims responsibility for updating such views, analyses or other information. Different views may be expressed based on different investment styles, objectives, opinions or philosophies. It should not be assumed that any investments in securities, companies, countries, sectors or markets described were or will be profitable. It should not be assumed that any investor will have an investment experience similar to any portfolio characteristics or returns shown. This material may contain statements that are not historical facts (i.e., forward-looking statements). Any forward-looking statements speak only as of the date they are made, and Hexavest assumes no duty to and does not undertake to update forward-looking statements. Forward-looking statements are subject to numerous assumptions, risks, and uncertainties, which change over time. Future results may differ significantly from those stated in forward-looking statements, depending on factors such as changes in securities or financial markets or general economic conditions. Not all of Hexavest’s recommendations have been or will be profitable.

This material is for the benefit of persons whom Hexavest reasonably believes it is permitted to communicate to and should not be reproduced, distributed or forwarded to any other person without the written consent of Hexavest. It is not addressed to any other person and may not be used by them for any purpose whatsoever. It expresses no views as to the suitability of the investments described herein to the individual circumstances of any recipient or otherwise.