Are telcos a value trap?

Our different regional teams have combined their observations on the sector. This article explains why our managers don't believe that telecommunications are a valuable trap.

June 27, 2018

The MSCI Global Telecom Sector Index had a very rough year in 2017, underperforming the MSCI World Index by 16%. This trend has continued since the beginning of 2018, with another 10% of underperformance. Yet, the sector was surprisingly cheap at the beginning of the year. In this context, the question of whether the telecom sector is a value trap is a legitimate one. We believe the answer is “no,” and the following aims to explain why.

A CHALLENGING MACRO ENVIRONMENT

We understand that rising interest rates can be detrimental to the telecom sector and that the competitive landscape could hurt the companies. This being said, we do see some positives on the macroeconomic front:

Competition has likely peaked for US telcos. At the start of 2017, all carriers went unlimited; there is not much further to go than that. The most aggressive player, which had been pushing prices lower, began to emphasize free cash flow and buybacks. Another factor reducing competition is longer handset cycles, which reduces churn and incentive for competition. As such, analysis performed by Morgan Stanley as of the end of Q1 2018 show that industry fundamentals are inflecting. In Q217, the industry began to see average revenue per user arrest its four-year decline. In Q417, for the first time since 2013, year-over-year revenue growth was positive.

In Europe, the regulatory environment has become friendlier to telecommunications operators. Thus, the scope for further consolidation is improving, which should limit competitive pressure in the future. In Asia-Pacific, however, we see continuing competitive pressures, as Japan, Australia and Singapore will all welcome a new entrant to their mobile markets by the end of 2019. On the other hand, it appears that pressure from mobile virtual operator networks (MVNOs), which have been gaining market share in recent years, is abating.

5G could provide a potential next leg of growth. While investors appear very excited about the internet of things and self-driving cars, they seem less interested about how these items will connect to the internet. The answer is likely via wireless networks and this could represent the next leg of growth for telcos.

Service providers in Asia-Pacific will likely benefit from exponential data usage and a growing contribution from nontelecom services. There is a strong trend in Asia to integrate telecommunications with other services such as content, financial services, food and daily necessities, and electricity; these can all be sold via the telcos’ existing customer relationship.

ATTRACTIVE FOR QUITE A WHILE NOW

The graph below illustrates the relative valuation of the global telecom sector versus the global market (the red line). Outside of a brief period in 2009, telcos are at their cheapest level in the last 10 years. While they were one standard deviation below their historical average in 2017, they are now two standard deviations below. In fact, relative valuation has continued to deteriorate year-to-date.

Looking at relative growth prospects, we believe investors appear to be overly punitive towards the sector on valuation. Presently, the MSCI World EPS growth is forecast at 11.5% vs. the MSCI World Telco at 2.5%, a difference of 9% (the blue line). To justify the current valuation, the earnings growth differential would need to expand by 15%. We believe just the opposite will occur. Our view is that the global EPS growth has peaked for the cycle, therefore bringing into question the 11.5% forecast. We expect that the less cyclical growth of telcos will hold better.

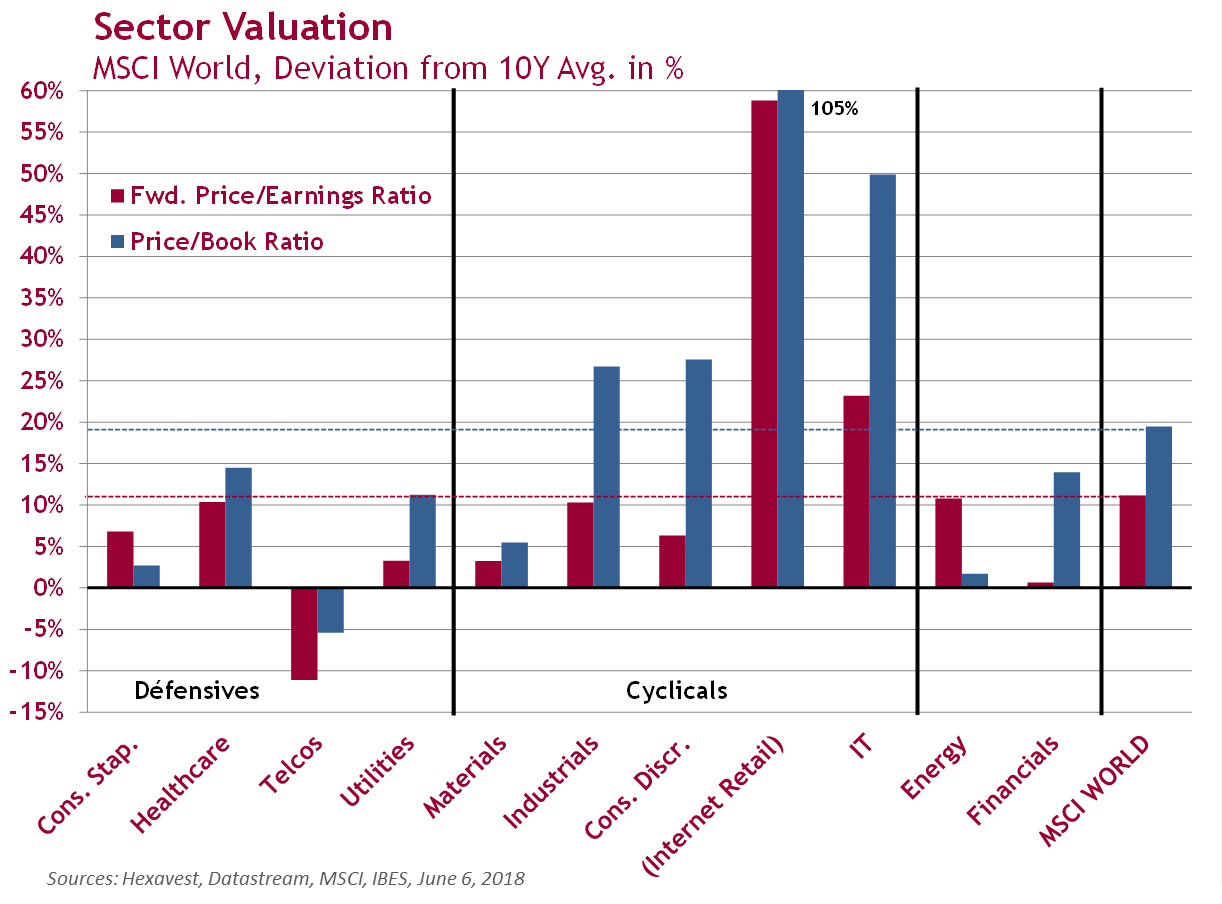

Those familiar with our market outlook know that our view is that most sectors are expensive. However, we believe that telcos are a notable exception to this view.

OVERLOOKED BY INVESTORS

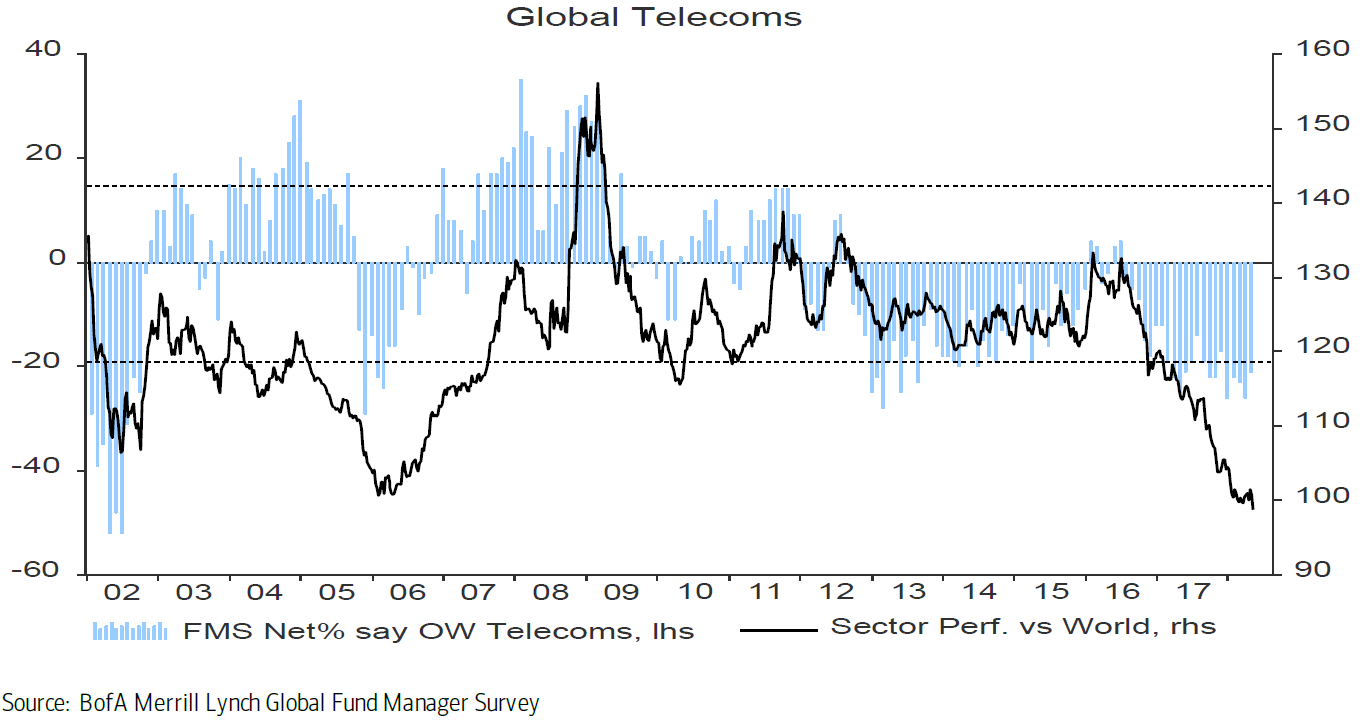

Various surveys we use for our research show that all types of investors currently underweight the telecom sector. The blue lines in the Funds Manager Survey chart below from BofA Merrill Lynch illustrate that global portfolio managers have been underweighting the sector for quite a long time now, increasing their underweight positions in 2017. The black line shows the relative performance of the sector; similar to valuation, it is at very low levels.

Given our contrarian approach with investor sentiment, we see this indicator as a very positive signal. It adds up to other surveys that show investors have a strong preference toward cyclical sectors, at the expense of defensive sectors, which include telecoms.

THE “NO VALUE TRAP” THESIS

Investors’ current lack of interest and the poor returns of the telecom sector recently conflict with the historical attractiveness of the sector. But when market experts talk about value traps, they usually refer to industries that are showing a contraction in EPS combined with low valuation. We don’t expect this to be the case for telcos. Historically, the companies have been able to deliver modest EPS growth, regardless of the economic cycle.

Based on our three-vector framework of analysis, we believe telcos are currently one of the most attractive sectors globally. We are negative on the macro, recognizing the potential headwinds facing the sector and its lower relative growth compared to other sectors. But we see some room for optimism, as an inflection in fundamentals seems underway, especially in Europe and the US. Where the sector gets very appealing to us, is on the valuation and sentiment vectors. Given the above, we don’t believe that telcos currently represent a value trap.

Sources: Hexavest, MSCI. MSCI data presented in this document are total return indices with net dividends reinvested. MSCI data may not be reproduced or used for any other purpose. MSCI provides no warranties, have not prepared or approved this report, and have no liability hereunder.

The information included in this document is presented for illustrative and discussion purposes only. It is meant to provide an example of Hexavest’s investment management capabilities and should not be construed as investment advice or as a recommendation to purchase or sell securities or to adopt any investment strategy. Any investment views and market opinions expressed are subject to change at any time without notice. This document should not be construed or used as a solicitation or offering of units of any fund or other security in any jurisdiction.

The opinions expressed in this document represent the current, good faith views of Hexavest at the time of publication and are provided for limited purposes, are not definitive investment advice, and should not be relied on as such. The information presented herein has been developed internally and/or obtained from sources believed to be reliable; however, Hexavest does not guarantee the accuracy, adequacy, or completeness of such information. Predictions, opinions, and other information contained herein are subject to change continually and without notice and may no longer be true after the date indicated. Hexavest disclaims responsibility for updating such views, analyses or other information. Different views may be expressed based on different investment styles, objectives, opinions or philosophies. It should not be assumed that any investments in securities, companies, countries, sectors or markets described were or will be profitable. It should not be assumed that any investor will have an investment experience similar to any portfolio characteristics or returns shown. There are no guarantees concerning the achievement of investment objectives, target returns, growth trajectories, earnings projections, allocations or measurements such as alpha, tracking error, stock weightings and information ratios. This material may contain statements that are not historical facts (i.e., forward-looking statements). Any forward-looking statements speak only as of the date they are made, and Hexavest assumes no duty to and does not undertake to update forward-looking statements. Forward-looking statements are subject to numerous assumptions, risks, and uncertainties, which change over time. Future results may differ significantly from those stated in forward-looking statements, depending on factors such as changes in securities or financial markets or general economic conditions. Past performance does not predict future results. Not all of Hexavest’s recommendations have been or will be profitable.

Hexavest is a minority-owned subsidiary of Eaton Vance and considered an affiliate of Eaton Vance Management. Investment entails risks and there can be no assurance that Eaton Vance (and its affiliates) will achieve profits or avoid incurring losses.

The information contained in this message is confidential. If you are not the intended recipient or received this communication by error, please notify us and delete the message without copying or disclosing it. No part of this document may be reproduced in any manner without the prior written permission of Hexavest