Yields are rising: Three strategy takeaways

U.S. Treasury yields are rising and are now hovering near their highest levels since 2011. Global sovereign yields are also joining the uptrend, volatility has picked up, and equities have struggled recently. After a decade of low/zero interest rates and ultra-accommodative monetary policy, we believe the ongoing increase in yields will trigger a shift in asset leadership.

October 17, 2018

To be sure, there have been many head fakes in recent years, and the “rising yield trade” has failed to materialize on a sustained basis. The key difference today is that central bank policy is aimed toward normalization, with price pressures (tight labor markets, rising input costs, vanishing output gaps) more likely to influence decisions until the end of the cycle. In our opinion, the upward move in bond yields highlights a deteriorating equity risk-reward outlook and pending style leadership shift. The following are three strategy takeaways from the uptrend in yields:

1 – Confirming late-stage status. Investors have been trying to determine the status of this equity cycle, and we believe rising yields and tightening monetary conditions are indicative of late stage, i.e. 8th-9th inning. Other “late-stage” indicators include flattening yield curves, historically low unemployment rates, and peaking/record profit margins. Real rates are not overly restrictive yet, but the uptrend in yields argues for an unattractive 12- to 18-month equity risk-reward outlook.

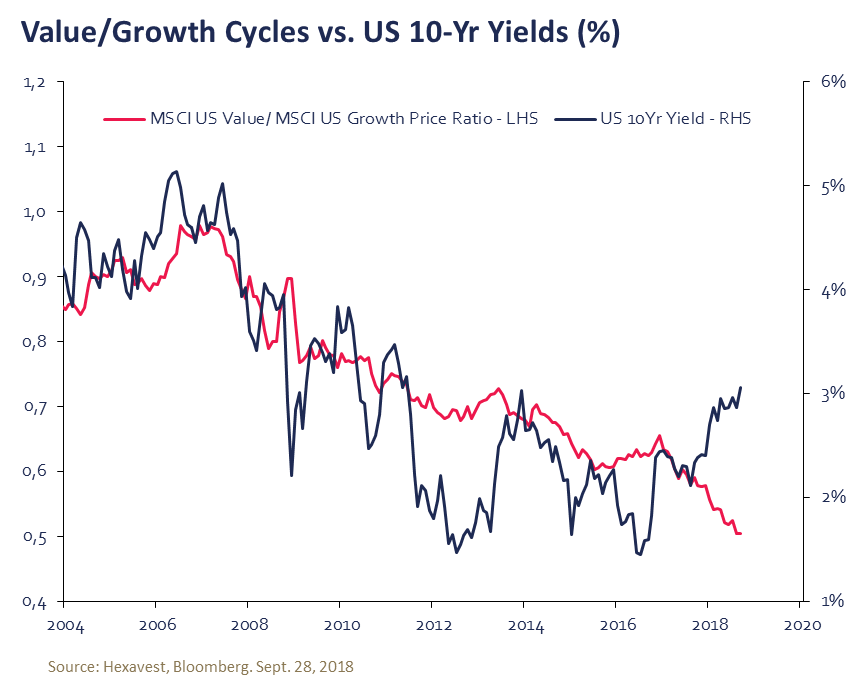

2 - Creating opportunity in value style. Since 2009, growth style has benefited from a recovering global economy through faster earnings growth, and in the last 18 months, U.S. growth’s domination has intensified following the U.S. tax reform. In addition to a supportive GDP backdrop, low/declining yields have pushed up valuations for growth companies (lower discount rate = higher price). Rising yields and tightening monetary conditions now threaten growth’s valuation premium, while the prospect of tightening monetary conditions should eventually impact economic growth, and hence earnings. Value style has underperformed for over a decade, and we believe rising yields could translate into a leadership shift.

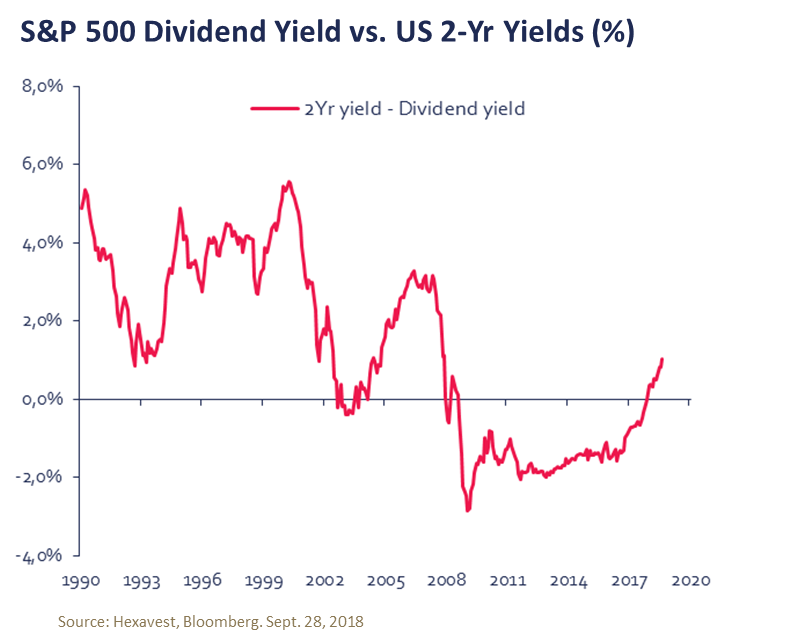

3 - Making defensives great again. As yields increase, the competition between bonds/defensives and equities/cyclicals will become more even. When yields hit “restrictive levels”, and eventually peak, defensives and cash should fully take the lead. In the U.S., short-term bonds (U.S. 2-year 2.85%) are now yielding over 100 basis points more than the S&P 500 dividend (1.8%), and the widening spread should favor bonds/cash over the next 12-18 months. Bottom line: We believe exposure to cash and defensives should increase as yields rise.

Strategy view: We believe pending negative revisions to world GDP and earnings growth threaten the macro environment, while valuation and sentiment are already a great concern. Although rising yields warrant a cautious strategy for equity portfolios, it could also translate into investment opportunities in defensive sectors and value stocks.

The information included in this document is presented for illustrative and discussion purposes only. It is meant to provide an example of Hexavest’s investment management capabilities and should not be construed as investment advice or as a recommendation to purchase or sell securities or to adopt any investment strategy. Any investment views and market opinions expressed are subject to change at any time without notice. This document should not be construed or used as a solicitation or offering of units of any fund or other security in any jurisdiction.

The opinions expressed in this document represent the current, good faith views of Hexavest at the time of publication and are provided for limited purposes, are not definitive investment advice, and should not be relied on as such. The information presented herein has been developed internally and/or obtained from sources believed to be reliable; however, Hexavest does not guarantee the accuracy, adequacy, or completeness of such information. Predictions, opinions, and other information contained herein are subject to change continually and without notice and may no longer be true after the date indicated. Hexavest disclaims responsibility for updating such views, analyses or other information. Different views may be expressed based on different investment styles, objectives, opinions or philosophies. It should not be assumed that any investments in securities, companies, countries, sectors or markets described were or will be profitable. It should not be assumed that any investor will have an investment experience similar to any portfolio characteristics or returns shown. This material may contain statements that are not historical facts (i.e., forward-looking statements). Any forward-looking statements speak only as of the date they are made, and Hexavest assumes no duty to and does not undertake to update forward-looking statements. Forward-looking statements are subject to numerous assumptions, risks, and uncertainties, which change over time. Future results may differ significantly from those stated in forward-looking statements, depending on factors such as changes in securities or financial markets or general economic conditions. Not all of Hexavest’s recommendations have been or will be profitable.

No part of this document may be reproduced in any manner without the prior written permission of Hexavest