November: A euphoric month for markets

December 9, 2020

In November, investors proved they were looking to the future, expressing their hope for a quick return to normality after a difficult year around the world. The stock markets celebrated the result of the U.S. presidential election, with the S&P 500 Index rising 4.0%—the largest increase in its history on the day following such an election. A Joe Biden presidency suggests less geopolitical uncertainty and greater co-operation with Europe on trade. And the markets recorded a second surge the following week after an effective COVID-19 vaccine was announced.

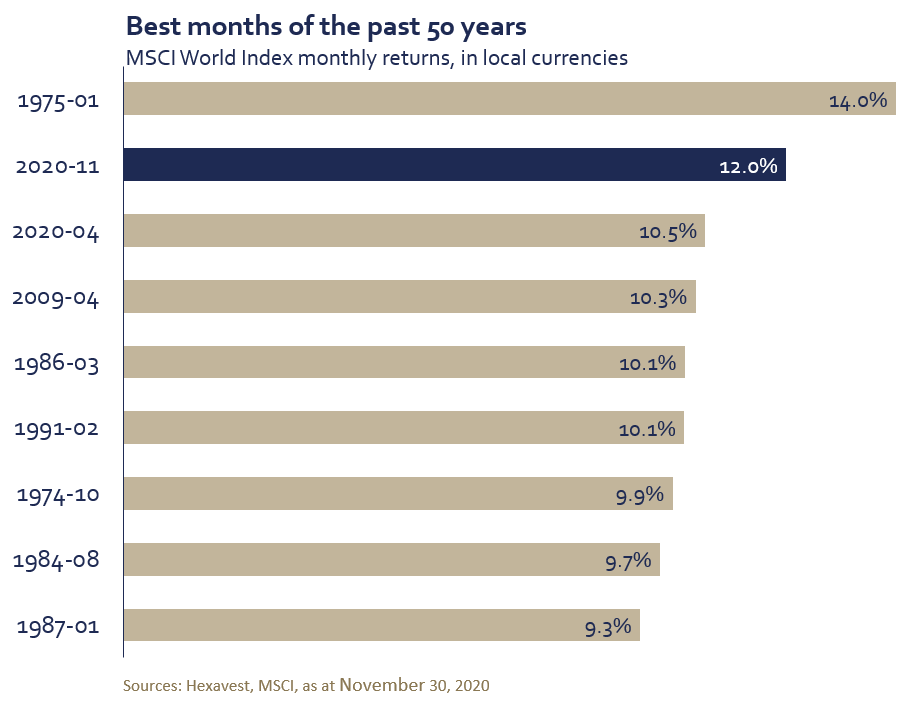

November also saw several other historical milestones. The Dow Jones Industrial Average crossed the psychological 30,000-point mark and ended the month with its highest return since 1987. Similarly, the MSCI World Index, established in 1969, had its second-best monthly return.

After rising more than 40% from its March low, the MSCI ACWI Index climbed another 11.5%, posting its best monthly return since its inception in January 2001. Most of its meteoric rise occurred at the start of the month, when it advanced 9.5% within a period of eight consecutive up days. This return would be appreciable on an annual basis, but it is exceptional for a period of slightly more than a week.

In addition to its strength and speed, the increase was remarkable for its breadth. In a rare occurrence, all the markets in the MSCI ACWI Index ended in positive territory. Most of the developed countries had returns above 10% and many surged more than 20%, with the same situation occurring in emerging markets. Sector returns also reflected the trend of widespread advances, with investors showing a clear preference for sectors they had shunned in recent months, such as energy, financials and service-related industries, at the expense of the defensive sectors, such as utilities and consumer staples.

Outlook

The markets’ euphoria leads us to believe that investors ignored short-term risks; moreover, the conclusions of our three investment vectors continue to point to a cautious approach. From the macroeconomic standpoint, even though we can see a glimmer of light at the end of the tunnel, the next three to six months will be difficult in terms of public health, and distancing measures will continue to be necessary. In addition, our valuation and sentiment vectors are indicating a speculative bubble.

The sudden and abrupt market frenzy has left managers with very little leeway to adjust their positions. Moreover, our fundamental research findings indicate that the deep wounds inflicted by health restrictions, including the pronounced deterioration in corporate balance sheets and the explosion of government deficits, will weigh on economic growth for a number of quarters, even though the vaccine developments have been a balm. We therefore expect the markets to revert to a more cautious tone in the months to come.

Source of all data and information: Hexavest and MSCI as at November 30, 2020, unless otherwise specified.

This material is presented for information and illustrative purposes only. The opinions expressed in this document represent the current, good-faith views of Hexavest at the time of publication and are provided for limited purposes, are not definitive investment advice, and should not be relied on as such. The information presented herein has been developed internally and/or obtained from sources believed to be reliable; however, Hexavest does not guarantee the accuracy, adequacy, or completeness of such information. Predictions, opinions, and other information contained herein are subject to change continually and without notice and may no longer be true after the date indicated. Hexavest disclaims responsibility for updating such views, analyses or other information. Different views may be expressed based on different investment styles, objectives, opinions or philosophies.

The MSCI ACWI Index is a broad-based securities market index and used for illustrative purposes only. The MSCI ACWI Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets. Performance for the MSCI ACWI Index is shown “net”, which includes dividend reinvestments after deduction of foreign withholding tax. Broad-based securities indices are unmanaged and are not subject to fees and expenses typically associated with managed accounts or investment It is not possible to invest directly in an index. MSCI data may not be reproduced or used for any other purpose. MSCI provides no warranties, has not prepared or approved this document, and has no liability hereunder.

Past performance does not predict future results. This material may contain statements that are not historical facts (i.e., forward-looking statements). Any forward-looking statements speak only as of the date they are made, and Hexavest assumes no duty to and does not undertake to update forward-looking statements. Forward-looking statements are subject to numerous assumptions, risks, and uncertainties, which change over time. Future results may differ significantly from those stated in forward-looking statements, depending on factors such as changes in securities or financial markets or general economic conditions. Not all Hexavest’s recommendations have been or will be profitable.

This material is for the benefit of persons whom Hexavest reasonably believes it is permitted to communicate to and should not be reproduced, distributed or forwarded to any other person without the written consent of Hexavest.