Are investors taking into account the growing list of concerns?

October 14, 2021

The global economy is facing a growing list of headwinds: Chinese real estate giant Evergrande’s potential default is creating jitters while supply-chain bottlenecks are leading to various shortages, including a lack of gasoline in the UK. Adding to those headaches, we saw increased government interventions that may seem unfavorable from investors’ perspective. China cracked down on a swath of industries while Spain introduced new regulations on utility companies to limit the negative impact of rising energy prices on households.

The political sphere was another area of concern, with investors assessing the potential for a US government shutdown as the country is approaching its debt ceiling. Acrimonious bi-partisan discussions will continue. Beyond the US borders, we saw general elections in both Canada and Germany, while Japan’s prime minister stepped down after only one year on the job. But when all said and done, the landscape has not changed dramatically. In Canada, Prime Minister Trudeau’s Liberal government was returned to power without a majority once again and so we should not expect any major policy shift in the years ahead.

The German election had the potential to have the most significant impact, with a new chancellor being elected after 16 years of Mrs. Merkel being at the helm. As the campaign progressed, polls suggested a shift to the left, bringing hopes for greater unity within Europe and less fiscal conservatism domestically. However, in the end, the race was much closer than expected between the two establishment parties. Potential coalitions to form the next government will likely lean towards the center. Most options include the Free Democratic Party, which supports fiscal conservatism and lower taxes. Coalition talks could last for several months, but the result will likely not be too far from what we have been accustomed to with Chancellor Merkel. In the near-term, the most important driver for the German economy is the evolution of the global economic cycle, as slower global growth and supply chain issues weigh on the manufacturing sector.

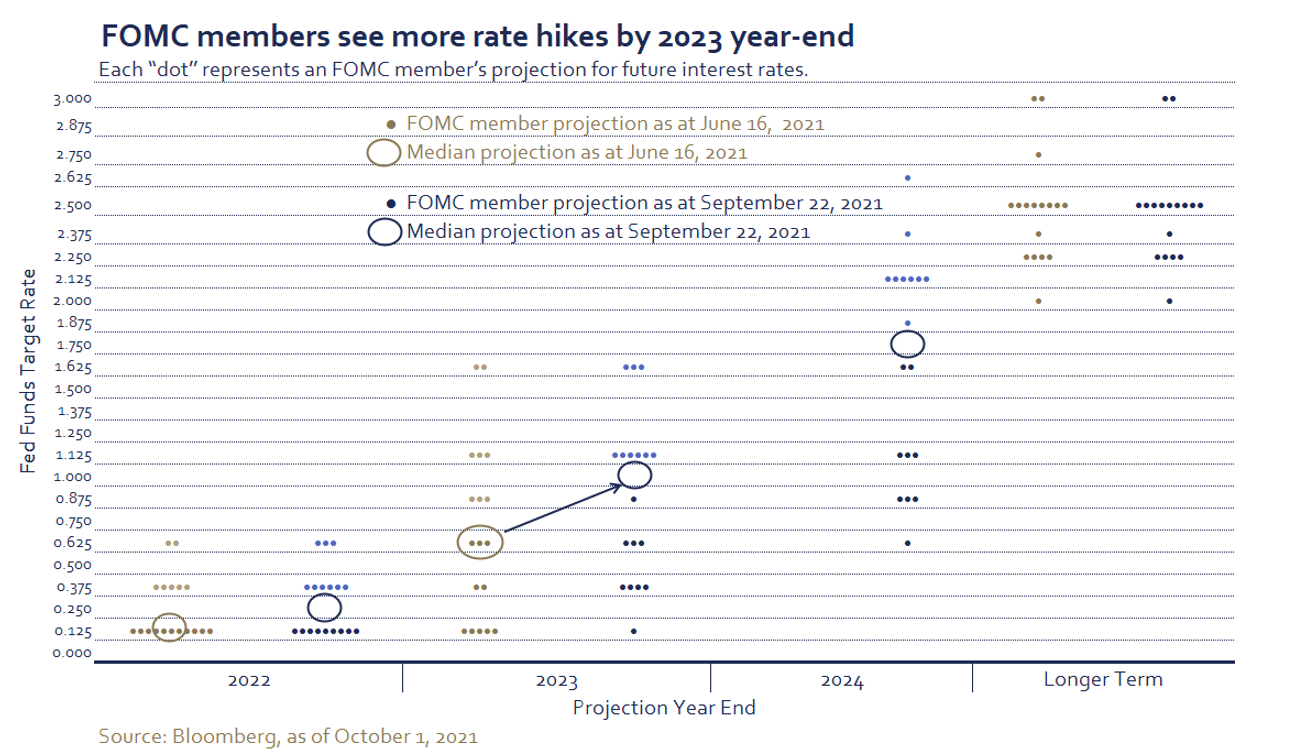

On the monetary policy front, Norway became the first developed country in developed markets to hike interest rates.1 The Norges Bank increased its benchmark rate from 0 to 0.25% and suggested that another hike was likely in December. At the same time, the US Federal Reserve indicated that it would likely begin tapering bond purchases in the coming months and that the tapering will be completed by the middle of next year. Federal Open Market Committee (FOMC) President Jerome Powell made sure to point out that tapering would not equate to higher interest rates. The forecasted path of interest rate hikes remains relatively benign, suggesting that monetary conditions should remain accommodative.

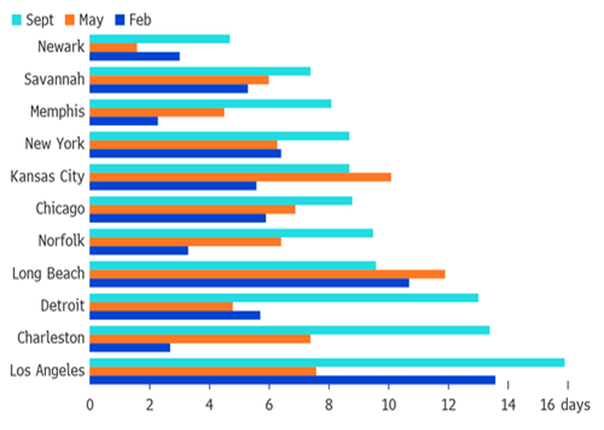

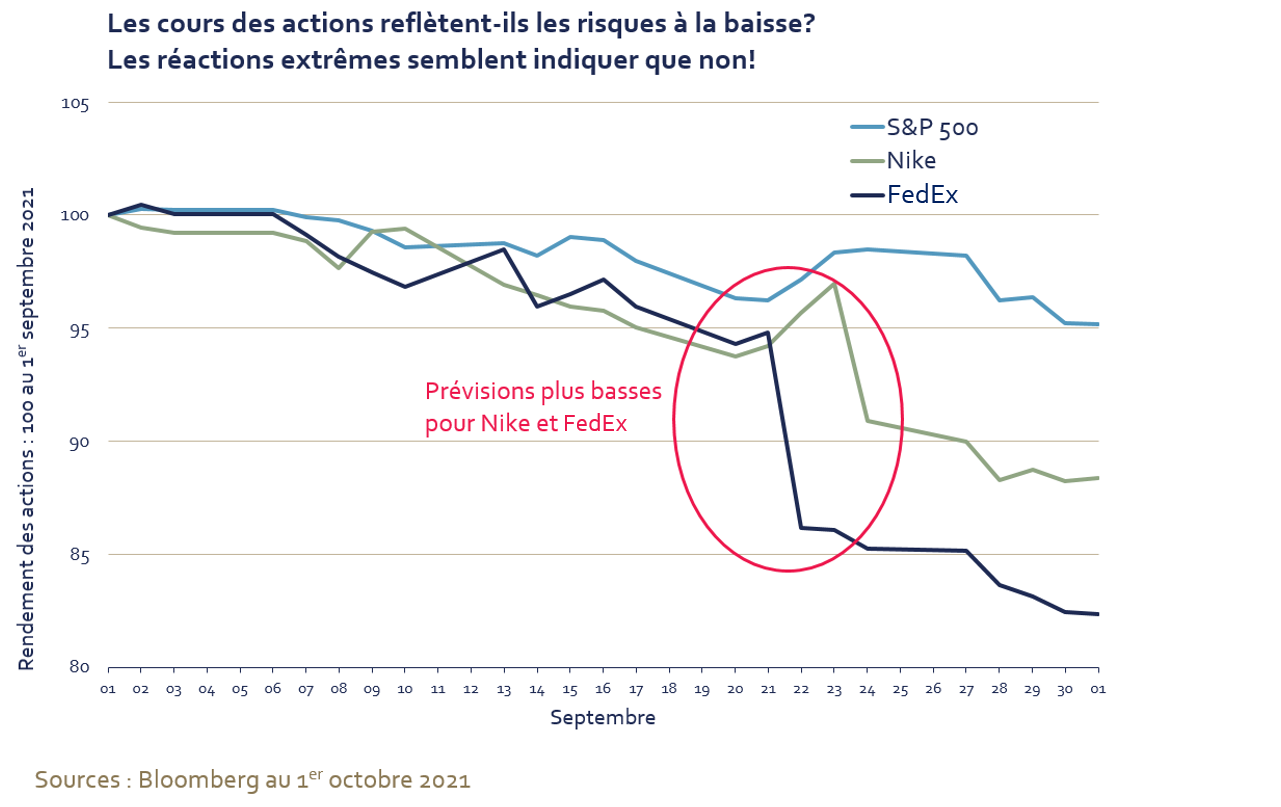

Lastly, a growing number of companies provided investors negative earnings previews due to the rising costs of doing business and supply chain disruptions2 that are weighing on profitability. Several large companies3 (Amazon, Walmart, McDonald’s, Costco, etc.) announced wage increases in response to labour shortages. However, supply chain disruptions cannot be as easily resolved, and this issue has moved beyond the semiconductor industry. For example, Sherwin Williams was forced to issue two profit warnings within 3 weeks because higher raw material prices and scarcity are limiting its production capacity4. FedEx and Nike also provided a gloomy outlook amid shipping disruptions. The cost of shipping goods has skyrocketed in recent months, while a shortage of truck drivers along with congestion in rail yards and ports have doubled the number of days it takes to ship goods from Asia to North America.5

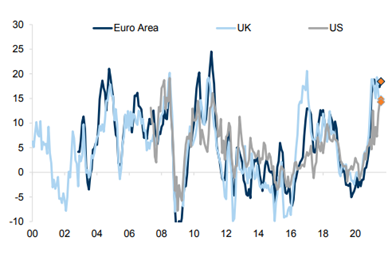

Input costs have risen sharply

Manufacturing PMIs: Input versus output prices

Sources: Haver Analytics, Goldman Sachs Global Investment Research, as of September 28, 2021

Warning Tracks: Dwell times for shipping containers at many US railyards are surging

Sources: Hapag-Lloyd, Bloomberg, as at September 24 2021

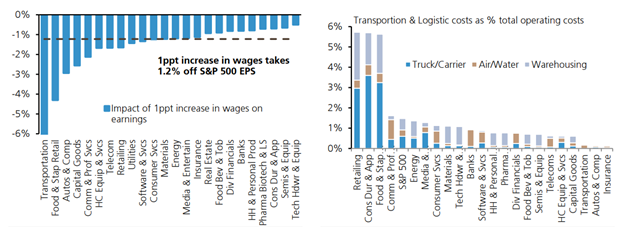

Some industries will be more impacted than others by these factors. A study by UBS suggests that a 1% rise in wages will reduce earnings by 1.2%, but such an increase would cause a 6% hit in the transportation industry. The retail and apparel industries are the biggest losers when it comes to rising transportation and logistics costs.

Rising costs of doing business

Impact of rising wages on sectors, and transportation costs across industries

Sources: BEA, Factset, UBS, as at September 28, 2021

Market performance

The string of consecutive monthly gains for global equities was broken last month, ending at 7 due to the MSCI ACWI index’ 3.6% fall in local currencies. Losses were broad-based: US equities retreated 4.8%, while European stocks declined slightly less, with a 3.0% drop. Emerging markets fared marginally better, having only slid 2.8%. In contrast, Japanese equities benefited from renewed optimism emanating from a change in government leadership and, as a result, the MSCI Japan index was up 4.4% in September.

More hawkish comments by FOMC Chairman Powell propelled sovereign yields higher, with the US 10-year treasury yield reaching its highest level in over 3 months and ending at 1.52%. Rising interest rates provided a much-needed boost for some of the most cyclically sensitive sectors, such as financials (-0.8%) and energy (+9.9%). Crude oil prices reached a 3-year high and sharply higher natural gas prices also helped boost energy stocks. The worst performing sectors in September were materials (-6.0%), utilities (-5.6%) and communication services (-5.5%).

The increase in yields proved beneficial to the US dollar, with the DXY index up almost 2%. Most currencies depreciated against the greenback, although commodity-linked currencies fared slightly better. The British pound was the worst performing currency in developed markets, falling 2%.

Conclusion

Given the elevated expectations, investors reacted strongly to negative news. We believe that financial market participants have only just begun to incorporate the long list of headwinds into their forecasts. A shift in expectations could bring more turbulence to financial markets.

We welcome any questions or comments you may have. We can be reached at service@hexavest.com.

Sources:

- Norway becomes the first central bank to hike rates post-Covid (cnbc.com)

- https://www.zerohedge.com/markets/containers-quickly-pile-us-rail-terminals-add-port-strains

- Amazon to hire 15,000 employees across Canada; increase wages | CTV News

- https://blinks.bloomberg.com/news/stories/R05UGD3MSFLT

- https://blinks.bloomberg.com/news/stories/QZXNLUDWRGG0

Important Information and Disclosure

Source of all data and information: Hexavest and MSCI as at September 30, 2021, unless otherwise specified.

This material is presented for information and illustrative purposes only. The opinions expressed in this document represent the current, good-faith views of Hexavest at the time of publication and are provided for limited purposes, are not definitive investment advice, and should not be relied on as such. The information presented herein has been developed internally and/or obtained from sources believed to be reliable; however, Hexavest does not guarantee the accuracy, adequacy, or completeness of such information. Predictions, opinions, and other information contained herein are subject to change continually and without notice and may no longer be true after the date indicated. Hexavest disclaims responsibility for updating such views, analyses or other information. Different views may be expressed based on different investment styles, objectives, opinions or philosophies.

All references to the “Hexavest ACWI equity portfolio”, to the “ACWI Equity representative portfolio”, to the “portfolio”, or to their performance in this document refer to an actual portfolio managed by Hexavest which is used to objectively represent the firm’s Global ACWI Equity strategy. The performance of this representative portfolio has been included in Hexavest’s ACWI Composite (Composite) since its inception in 2014. The Composite includes portfolios that invest primarily in equities of companies located in the developed markets and emerging markets of Americas, Europe & Middle East, and Asia Pacific. Hexavest uses an investment approach that is predominantly “top-down” to construct diversified portfolios that typically contain more than 275 stocks. Asset allocation between regions, countries, currencies, and sectors can deviate substantially from that of the benchmark. Some portfolios may invest a small portion of their assets in countries and currencies not included in the benchmark. A client’s actual holdings, performance and investment experience will be different from that shown.

Gross-of-fee performance results are presented before management and custodial fees but after all trading commissions and withholding taxes on dividends, interest, and capital gains, when applicable. Such fees and expenses would reduce the results shown. Fee levels may vary from client to client depending on the portfolio size and the ability of the client to negotiate fees.

The MSCI ACWI Index is a broad-based securities market index and used for illustrative purposes only. The MSCI ACWI Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets. Performance for the MSCI ACWI Index is shown “net”, which includes dividend reinvestments after deduction of foreign withholding tax. Broad-based securities indices are unmanaged and are not subject to fees and expenses typically associated with managed accounts or investment It is not possible to invest directly in an index. MSCI data may not be reproduced or used for any other purpose. MSCI provides no warranties, has not prepared or approved this document, and has no liability hereunder.

Past performance does not predict future results. This material may contain statements that are not historical facts (i.e., forward-looking statements). Any forward-looking statements speak only as of the date they are made, and Hexavest assumes no duty to and does not undertake to update forward-looking statements. Forward-looking statements are subject to numerous assumptions, risks, and uncertainties, which change over time. Future results may differ significantly from those stated in forward-looking statements, depending on factors such as changes in securities or financial markets or general economic conditions. Not all Hexavest’s recommendations have been or will be profitable. Investing entails risks and there can be no assurance that Hexavest will achieve profits or avoid incurring losses. It should not be assumed that any investor will have an investment experience similar to returns shown.

This material is for the benefit of persons whom Hexavest reasonably believes it is permitted to communicate to and should not be reproduced, distributed or forwarded to any other person without the written consent of Hexavest.