And here we were thinking COVID was a thing of the past!

December 13, 2021

Most of us likely looked forward to the day when COVID would not be part of our vocabulary. Merck and Pfizer’s announcement regarding the successful development of a treatment against the virus provided hope to investors that COVID would soon be behind us. In retrospect, it was too good to be true; even before the emergence of a new variant (Omicron) there was a resurgence of infected patients in many European countries, which led to strict lockdown measures in Austria.

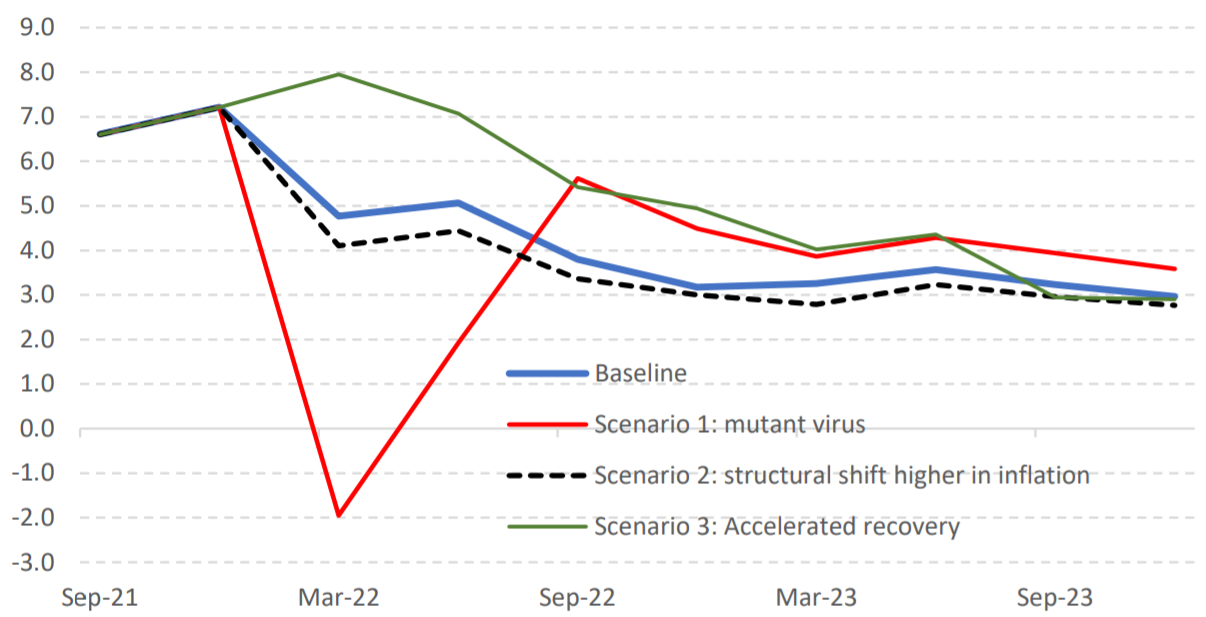

It is too early to quantify what the impact of the new variant will be on global economic activity. However, it is worth noting that in their most recent Economic Outlook report the research analysts at UBS concluded that the hit to global GDP growth could be as much as 2.1%, with most of the negative shock coming in the first 6 months.

Global GDP growth expectations

Sources: UBS, Haver, as of November 8, 2021

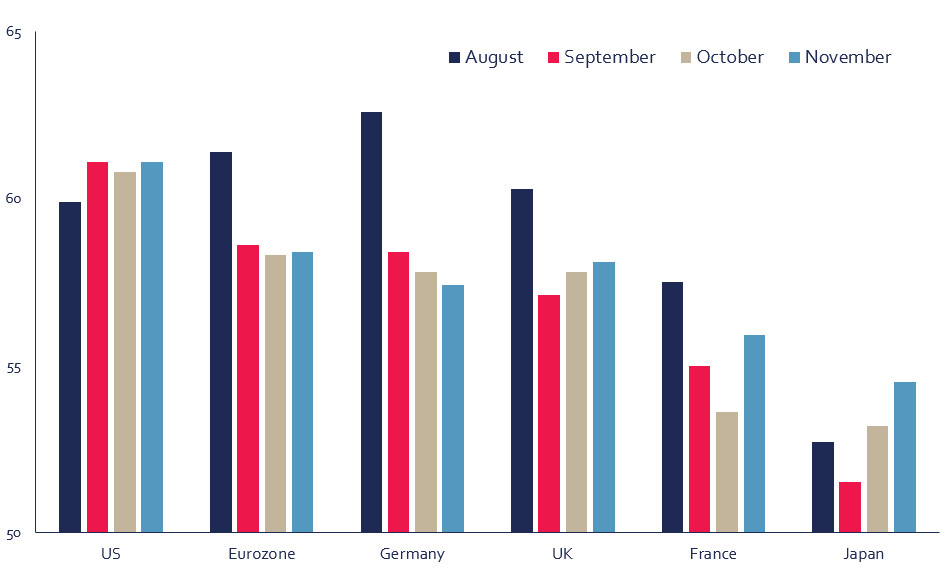

In Europe, a significant number of countries, including Germany, the Netherlands and Austria, have experienced a sharp increase in infection rates. One of the biggest risks for the region’s economic prospects is Germany, where the manufacturing sector was already suffering from the marked slowdown in global trade and the automotive sector. In November, Germany saw its manufacturing PMI index decline, while most other developed countries recorded a small gain. So far the newly formed government coalition has declined to introduce severe restrictions on mobility, but the evolution of the new variant could spell trouble, as Germany is already dealing with an unprecedented number of infections.

Global manufacturing PMI

Sources: Bloomberg, as of November 29, 2021

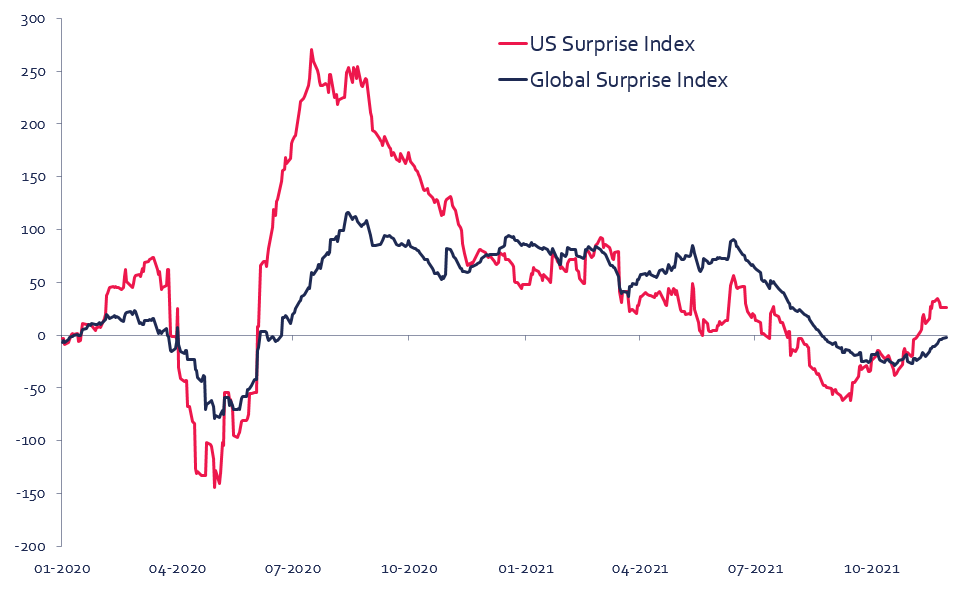

The US economy continues to make progress despite the persistent headwinds of rising wages, labour shortages and supply-chain constraints. The number of unemployed workers continues to decline: jobless claims have fallen below 200,000—the lowest level since 1969—while the number of continuing claims was the lowest since the pandemic started. Recently published economic data in the US has been better than in the rest of the world, supporting the case for better assessment of the macroeconomic vector in the US. But the picture is not all rosy for the US economy, with the pending expiry of the government funding bill in early December and the prospect of the US Treasury running out of cash by mid-December if the debt ceiling is not raised.2. However, the proverbial can has been kicked down the road a number of times in the past and for that reason investors do not appear to be overly concerned.

Citigroup Economic Surprise Index

Unites States vs the rest of the world

Sources: Bloomberg, Hexavest, as of November 29, 2021

Market performance

After a solid rebound in the first week of the month, November proved to be a bit more tumultuous for investors. The MSCI ACWI index gained over 2% in the first 6 days of trading, but these gains were offset in the second half of the month as losses accelerated following the discovery of a new COVID variant. While the MSCI ACWI index posted a decline of 1.7% last month, the quarter-to-date return remains healthy at 3.2%, and the increase over the prior 12 months is 21.1%.

During this period of heightened volatility and uncertainty, the US equity market fared better, with a loss 0.7%. The rest of the world recorded higher loses as emerging markets continue to trail, and Chinese equities were unable to shake the uncertainty surrounding the country’s economy and real estate markets. The MSCI EM index declined 3.2% in November, with a 5.9% drop for the MSCI China index. In Europe, France fared better than its regional peers, with a decline of 1.5%, compared to -2.4% for the MSCI Europe index. Owing to a higher COVID vaccination rate, France was able to avoid the worst of the most recent wave of the disease that hit the region.

The rally in energy stocks ran out of steam in November as the price of oil stumbled from recent highs. The US government led several countries in releasing oil from their strategic reserves, but investors’ fears over travel restrictions imposed because of the Omicron variant could weigh on demand for crude products. The MSCI ACWI Energy index fell 5.5% last month.

Amid higher uncertainty in the latter half of the month, investors reached into consumer staples for safety but remained confident enough that high growth technology stocks would continue to outperform. For the month, the Technology sector was the best performing, with a gain of 2.8%, while Consumer Staples limited its losses to 1.6%.

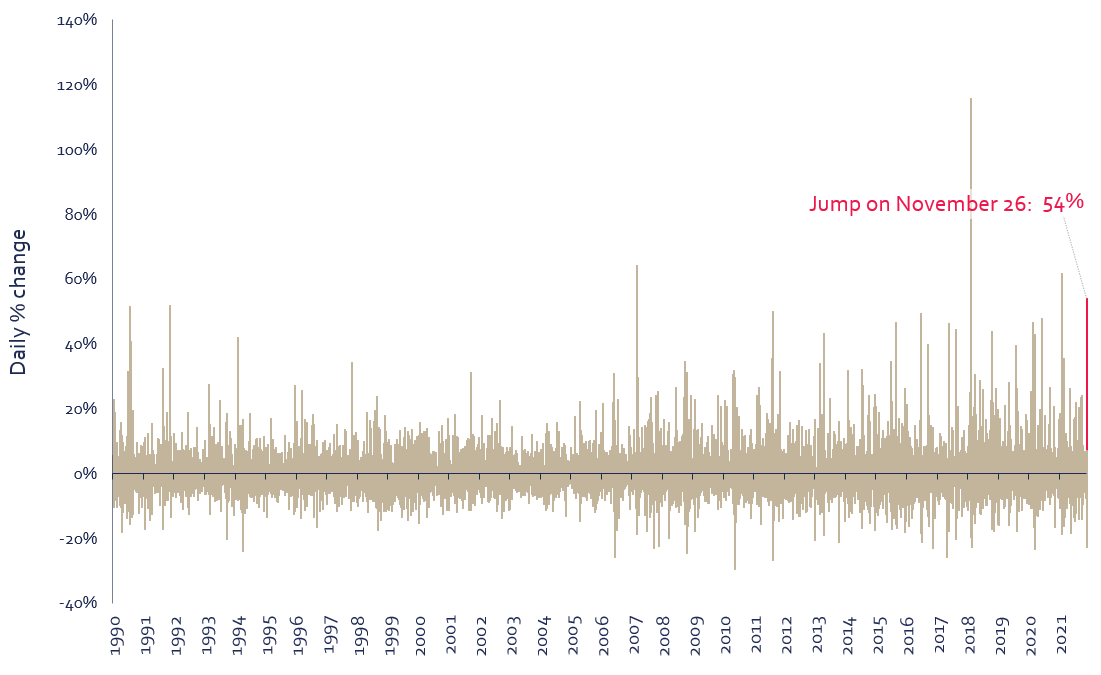

The chaotic financial markets over the US Thanksgiving weekend attest to a degree of nervousness on the part of investors. We have been arguing for quite some time that financial markets are priced for perfection and leave little room for error. The announcement of a new COVID variant is one example of this, as investors quickly ran for the exit, leaving in their wake one of the largest jumps in volatility recorded over the last 30 years.

US equity market volatility

VIX Index daily % change

Sources: Bloomberg, Hexavest, as of November 29, 2021

Another sign of wavering investor sentiment despite equity markets being near record levels is the fact that almost half of the large IPO in 2021 are currently trading below their listing price.1 This could be a sign that investors are not interested in paying the high valuation multiples being asked by the companies looking to publicly list their stock.

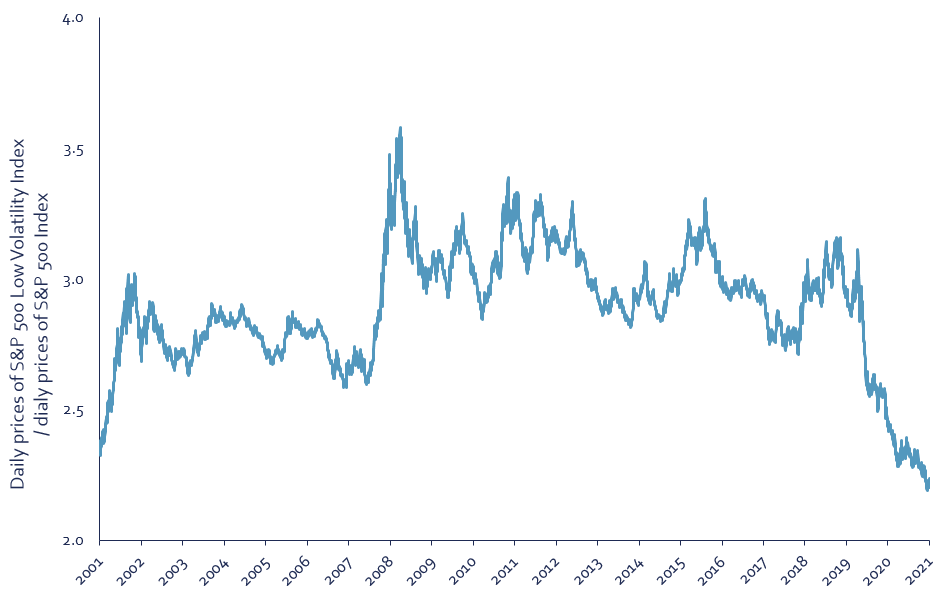

That said, investors’ desire to own high beta stocks remains intact. The least volatile stocks outperformed during periods of significant drawdowns for global equity markets, but the general trend of underperformance has remained unchallenged over the last 2 years.

Low volatility stocks remain out of favour

S&P 500 Low Vol Index vs S&P 500 Index

Sources: Bloomberg, Hexavest, as of November 29, 2021

Conclusion

It is likely that by the time you read this letter we already have answers to the many questions concerning Omicron. That said, we are hoping for the best but preparing for the worst, as extended valuations do not provide a cushion for unexpected surprises.

We welcome any questions or comments you may have. We can be reached at service@hexavest.com

Sources:

1- Half of this year’s big IPOs are trading below listing price, Financial Times, November 28, 2021

2- Government shutdown: Congress aims to pass funding bill (cnbc.com), November 29, 2021.

Important Information and Disclosure

Source of all data and information: Hexavest and MSCI as at November 30, 2021, unless otherwise specified.

This material is presented for information and illustrative purposes only. The opinions expressed in this document represent the current, good-faith views of Hexavest at the time of publication and are provided for limited purposes, are not definitive investment advice, and should not be relied on as such. The information presented herein has been developed internally and/or obtained from sources believed to be reliable; however, Hexavest does not guarantee the accuracy, adequacy, or completeness of such information. Predictions, opinions, and other information contained herein are subject to change continually and without notice and may no longer be true after the date indicated. Hexavest disclaims responsibility for updating such views, analyses or other information. Different views may be expressed based on different investment styles, objectives, opinions or philosophies.

All references to the “Hexavest ACWI equity portfolio”, to the “ACWI Equity representative portfolio”, to the “portfolio”, or to their performance in this document refer to an actual portfolio managed by Hexavest which is used to objectively represent the firm’s Global ACWI Equity strategy. The performance of this representative portfolio has been included in Hexavest’s ACWI Composite (Composite) since its inception in 2014. The Composite includes portfolios that invest primarily in equities of companies located in the developed markets and emerging markets of Americas, Europe & Middle East, and Asia Pacific. Hexavest uses an investment approach that is predominantly “top-down” to construct diversified portfolios that typically contain more than 275 stocks. Asset allocation between regions, countries, currencies, and sectors can deviate substantially from that of the benchmark. Some portfolios may invest a small portion of their assets in countries and currencies not included in the benchmark. A client’s actual holdings, performance and investment experience will be different from that shown.

Gross-of-fee performance results are presented before management and custodial fees but after all trading commissions and withholding taxes on dividends, interest, and capital gains, when applicable. Such fees and expenses would reduce the results shown. Fee levels may vary from client to client depending on the portfolio size and the ability of the client to negotiate fees.

The MSCI ACWI Index is a broad-based securities market index and used for illustrative purposes only. The MSCI ACWI Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets. Performance for the MSCI ACWI Index is shown “net”, which includes dividend reinvestments after deduction of foreign withholding tax. Broad-based securities indices are unmanaged and are not subject to fees and expenses typically associated with managed accounts or investment It is not possible to invest directly in an index. MSCI data may not be reproduced or used for any other purpose. MSCI provides no warranties, has not prepared or approved this document, and has no liability hereunder.

Past performance does not predict future results. This material may contain statements that are not historical facts (i.e., forward-looking statements). Any forward-looking statements speak only as of the date they are made, and Hexavest assumes no duty to and does not undertake to update forward-looking statements. Forward-looking statements are subject to numerous assumptions, risks, and uncertainties, which change over time. Future results may differ significantly from those stated in forward-looking statements, depending on factors such as changes in securities or financial markets or general economic conditions. Not all Hexavest’s recommendations have been or will be profitable. Investing entails risks and there can be no assurance that Hexavest will achieve profits or avoid incurring losses. It should not be assumed that any investor will have an investment experience similar to returns shown.

This material is for the benefit of persons whom Hexavest reasonably believes it is permitted to communicate to and should not be reproduced, distributed or forwarded to any other person without the written consent of Hexavest.