A-Shares: The long march (to full inclusion)

May 17, 2019

Reading headlines about A-Shares have recently become a daily routine for investors interested in Chinese equities. With the gradual inclusion of these shares in the MSCI Emerging Markets (MSCI EM) and MSCI All-Country (ACWI) indexes, the pace of foreign institutional flows is intensifying. Year-to-date, the CSI 300 index (the China Securities Index that includes the 300 largest A-shares) has gained 34% (as at April 30, in USD), far outpacing advances from the MSCI China (+20%) and MSCI EM (+12%). Is this just a frenzy or are we dealing with a more durable trend? Here are the key factors our Emerging Markets team considers when investing in A‑shares.

A-shares are mostly driven by domestic players and retail investors

A-shares refer to shares of companies based in China mainland listed on either the Shanghai or Shenzhen stock exchanges. These shares are quoted only in China’s currency, the renminbi. There are two other classes for Chinese equities: the B‑shares, which are listed in foreign currencies and have been opened to qualified foreign institutional investors since 2003 (QFII), and H‑shares, which are issued in Hong Kong by mainland companies and listed in Hong Kong dollars. In practice, foreign investors have only been able to purchase A-shares since last year. As of the end of March 2019, China’s central bank estimates that foreign investors own only about 2.6% of the A‑share market.

One of the consequences of the Chinese authorities’ fight against capital outflows is that Chinese investors have been refrained from investing in Hong Kong, which means that they have overly concentrated their investments in A-shares (and real estate, but this is another matter). Another characteristic of the Chinese equity market is that individuals (i.e. retail) make up a large portion of the A-share investor base; institutions typically have a bigger weight in developed markets. Morgan Stanley estimates that as of Q1, retail investors held over 50% of total free-float market cap in Chinese A-shares and contributed north of 80% to the A-share market's daily turnover.

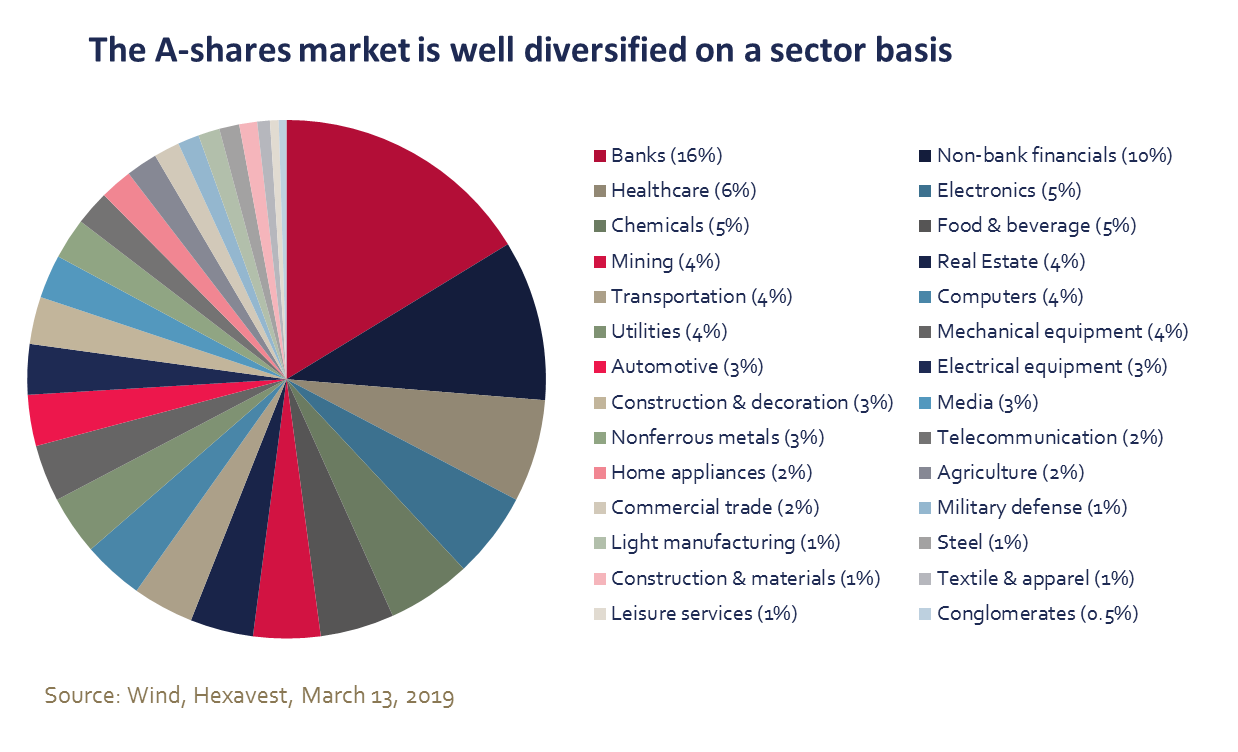

A-shares also offer a diversified and more appealing set of opportunities than B- and H-shares. There are about 3,600 stocks listed on both Shanghai and Shenzhen, compared to 2,800 on the New York Stock Exchange and 3,300 on the NASDAQ. Typically, foreign investors have been attracted to H-shares, a market heavily geared toward financials and internet-related stocks. The A-shares market is well-diversified in terms of sectors and industries, and much less geared toward internet-related stocks.

So far, most of the largest Chinese technology-related companies (Tencent, Alibaba, Baidu) have raised funds abroad and are listed offshore. This does not fit the Chinese authorities’ goals, as they would like to create a buoyant technology sector in mainland China, capable of raising funds locally (and, therefore benefiting local investors). In our view, there will be a strong push to list startups and so-called unicorns on either ChiNext (China’s closest equivalent to the NASDAQ) or on the newly announced Shanghai tech board. This will likely be a driver for the Chinese market over the next few years.

A long but seemingly unavoidable inclusion in the MSCI EM Index

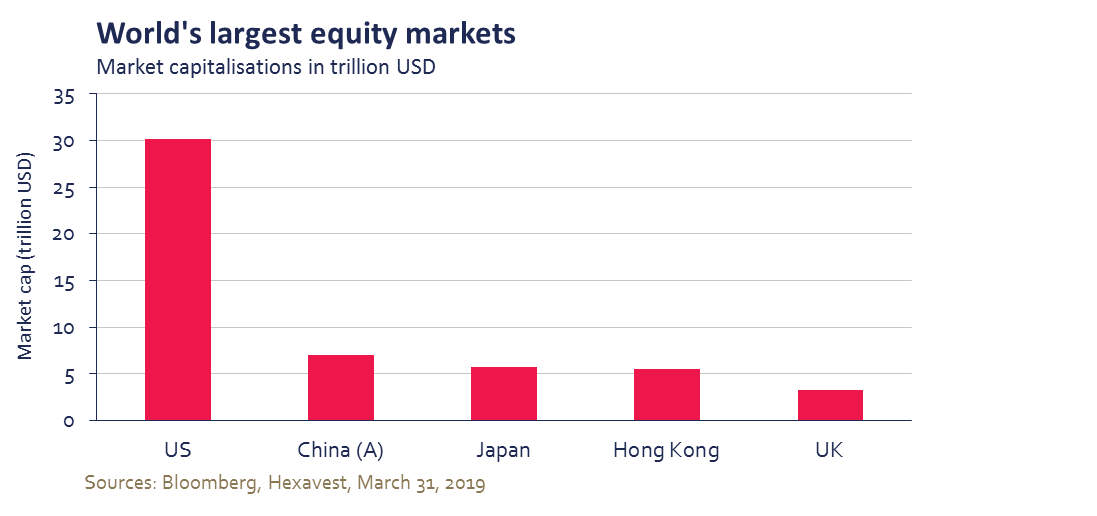

The debate about the pros and cons of including A-shares within the MSCI EM Index has been lingering for a couple of years. A-shares are now the second-largest market in the world in terms of market capitalization, thus becoming too big to ignore.

Moreover, these shares are much more representative of China’s real economy than the H-shares, which are currently included in global equity market indexes (MSCI World and MSCI ACWI). On the other hand, despite significant improvements made over the last few years, Chinese equities are still plagued by opaque disclosure practices, high stock price volatility for no apparent reason, frequent quotation suspensions and difficult access for foreign investors.

To facilitate the inclusion process, MSCI found in its archives the long-forgotten concept of “partial inclusion factor,” which paved the way for a progressive inclusion in the MSCI China Index. At the moment, the partial inclusion factor of A-shares is still only 5%, double its initial amount of 2.5% in 2018. This explains why so many large-cap stocks with a large free float only account for a couple of basis points in the MSCI EM Index.

What is changing in 2019 and the implications

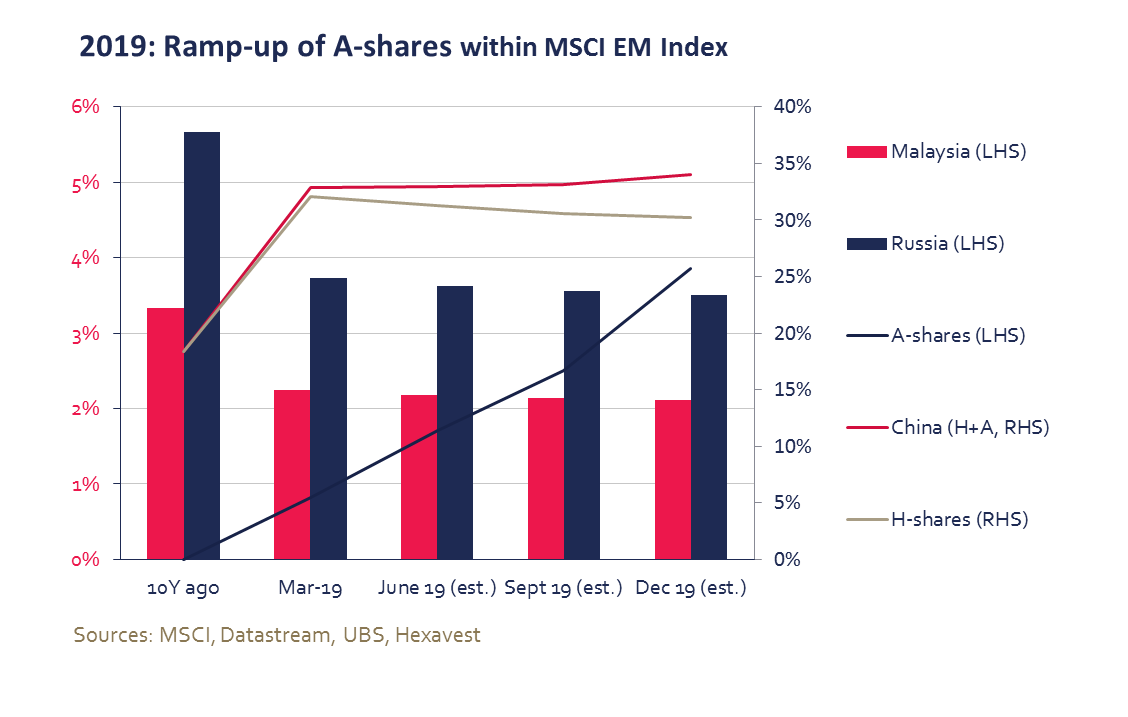

At the end of February, MSCI decided to further increase the weight of A-shares in the MSCI indexes in three steps. The timeline and road map for this year is:

- June: Doubling the China A large-cap inclusion factor from 5% to 10% and adding ChiNext large-cap shares with a 10% inclusion factor

- September: Increasing the inclusion factor of all China A large-cap shares from 10% to 15%

- December: Increasing the index inclusion factor of all China A large-cap shares from 15% to 20%; adding China A midcap shares, including some ChiNext shares with a 20% inclusion factor

The bottom line is that the weight of A-shares (currently 0.8% of the MSCI EM Index) should hover near 4.0% by year-end. To put things in perspective, the weight of A-shares alone would be larger than the weighting of Poland by the end of June, Malaysia by September and Russia by December. Morgan Stanley estimates that the 2019 A-shares index inclusions by MSCI and FTSE Russell should bring substantial foreign inflows, ranging from US$70 billion to US$125 billion in 2019.

Over the long term, the inclusion factor should continue to increase, which implies that inflows could maintain this pace for the years to come. We, therefore, expect hundreds of billion dollars of investments in A-shares. Although the weight of overall emerging-market equities will gradually increase in the MSCI ACWI, we anticipate significant outflows from other emerging countries, as their weight will be crowded out by China in the index.

Peculiarities to bear in mind

Foreign investors in China face many potential hurdles such as lack of liquidity and financial information, foreign ownership limits, double listings and potential foreign exchange risk. We believe some of these fears may be overblown, but we are carefully watching the following underlying risks:

Liquidity

Liquidity per se should not be an issue. According to various brokers we met with, including UBS, Merrill Lynch, JP Morgan, CLSA and Morgan Stanley, liquidity was still fairly good during last December’s trough: one-third of shares traded more than US$10 million worth each day, and more than half traded at more than US$5 million. Furthermore, almost one-third had a daily turnover in excess of US$10 million. Since A-shares are still vastly owned by Chinese retail investors, volatility is generally high and liquidity conditions can vary significantly. We believe this situation will normalize over time as institutional investors, both foreign and domestic, progressively ramp up their investments in this market, but this should occur only in the long term.

Foreign investors and foreign ownership limits

It remains difficult to know the exact number of shares in a company held by foreign institutional investors. The current foreign ownership limit for a company is set at 30%. Recent experience has shown that once the ratio has reached 28%, MSCI reacted promptly and removed it from the index (coinciding with a pullback of the stock price the next day). Only a handful of stocks are currently close to the limit, but accelerating inflows could result in an increasing trend of stocks being closed to further foreign investment. Over time, we believe that Chinese authorities will likely raise the foreign ownership limit, but no timeline is available at this stage.

Double listings and buying stocks at a premium

Currently, 112 stocks have a double listing, being traded on both the A-share and H-share markets. Since it is fairly difficult for domestic investors to invest in H-shares due to capital controls or in B‑shares because of limited access to foreign currencies, most A-shares trade at a premium relative to their H-shares equivalent (the average premium was 23% as of May 13, 2019). Since double-listed shares represent about one-third of the total A-shares market capitalization, the likely convergence between the valuations of A- and H-shares is, in our view, a risk associated with holding an ETF over the long term.

Hype or sustainable rally ?

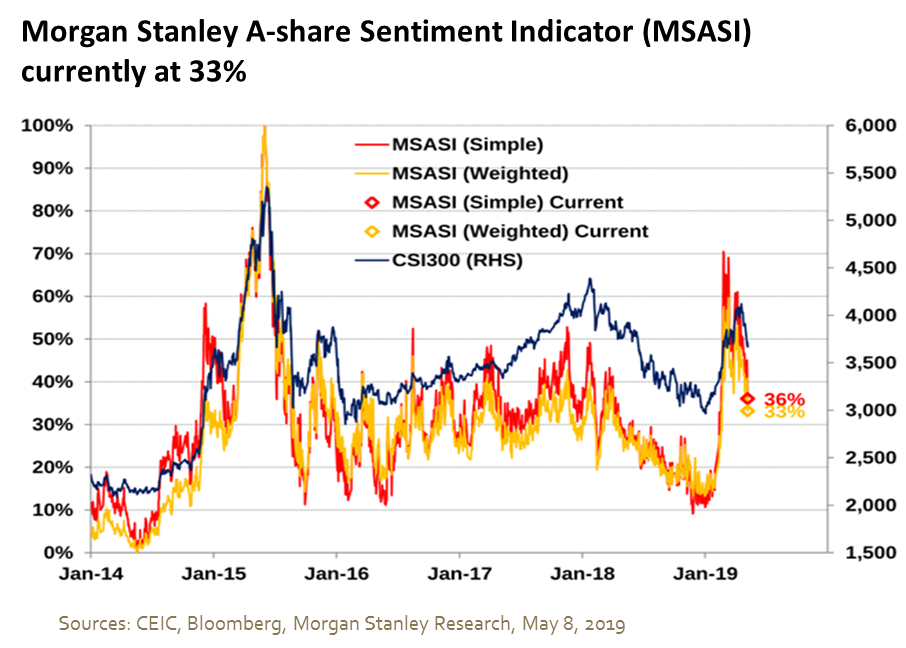

Morgan Stanley recently published an A-share sentiment indicator (MSASI), which has jumped from trough levels to above 50% alongside the market rally in Q1 2019. This index suddenly retreated towards the 33% level on the back of the negative headlines linked to the trade war with the USA, signaling that investor sentiment is currently fairly bearish again. For the first time in many years, we noticed headlines about investors remortgaging their apartment in order to participate in the market rally. However, no credible data has been released showing evidence of this trend. Still, there are probably enough signs of the beginning of a bubble to worry Chinese authorities, with a government official mentioning that the (local) market is “active enough.” Merrill Lynch noted that this comment was promptly followed by local brokers downgrading a couple of large companies to “sell” (which rarely happens in China), and local media reported that the government had instructed brokers to base their recommendations on fundamentals, which has proven an effective way to regulate stock prices. And if this was not enough, another vice chairman at the China Banking and Insurance Regulatory Commission said on March 11 that the regulator will not promote further buying of A-shares through wealth management products (Source: Merrill Lynch).

Strategy and conclusion

For top-down equity managers like us, A-shares appear to be an interesting investment. From a fundamental perspective, A-shares are a better proxy of the Chinese economy, offering a complementary reflection of the opportunity set compared to H-shares. Moreover, the A-share market is the second largest in the world, thus offering an array of opportunities in terms of diversity, and is simply too big to ignore in our opinion.

Within our emerging-market portfolios, we generally held an overweight position in A-shares since their inclusion in the index last year. This exposure had been initially implemented via an ETF, but we are starting to see a number of factors that seem to be calling for direct investment in stocks:

- By year-end, the MSCI A-share index will include 253 large caps and 168 midcaps, which is significant relative to the 1,125 constituents of the MSCI EM Index (as at March 2019). So far, the CSI 300 index has been tracking the MSCI China A index quite closely. However, we expect it to start diverging once ChiNext stocks, and their large contingent of midcap companies, are included in the index.

- The quality of financial information is slowly improving. Opacity had been a lingering problem for Chinese equities, and more so for many A-shares. However, we note that some brokers have increased their coverage substantially, and regulators seem serious about enforcing better reporting standards.

- As a general rule, we prefer not to invest in stocks that trade at a premium. Given the hefty premium double-listed A-shares are now trading at and their significant weight in certain ETFs, we believe there is a strong rationale for reducing our ETF holdings while increasing exposure to companies trading only as A-shares.

- From a macro perspective, we started increasing our portfolio’s weighting in middle-class consumption-related stocks as further details of the ongoing stimulus are becoming clearer (including tax cuts and tax deductions). These are more readily available within the A‑shares market.

Within our emerging-market portfolios, we expect to maintain an overweight position in Chinese A‑shares as we believe they will benefit from a higher inclusion factor in the index and from the ongoing stimulus. We bear in mind that A-shares, H-shares and Chinese ADRs are all Chinese companies, and that the differences among them will likely be blurred over time. However, we remain mindful of the changing dynamics in the marketplace and their impact on valuation and investor sentiment. Yet, in the short term, as we already have an overweight position, we would avoid increasing it further, given the rally that occurred over the last three months. However, we note that further market consolidation would likely provide an investment opportunity.

Source of all data: Hexavest as at April 30, 2019, unless otherwise specified. The MSCI EM, MSCI China and MSCI ACWI returns presented are those of the MSCI in local currencies. MSCI data presented may not be reproduced or used for any other purpose. MSCI provides no warranties, has not prepared or approved this report, and have no liability hereunder. Past performance does not predict future results.

This material is presented for informational and illustrative purposes only. It is meant to provide an example of Hexavest’s investment management capabilities and should not be construed as investment advice or as a recommendation to purchase or sell securities or to adopt any particular investment strategy. Any investment views and market opinions expressed are subject to change at any time without notice. This document should not be construed or used as a solicitation or offering of units of any fund or other security in any jurisdiction.

The opinions expressed in this document represent the current, good-faith views of Hexavest at the time of publication and are provided for limited purposes, are not definitive investment advice, and should not be relied on as such. The information presented herein has been developed internally and/or obtained from sources believed to be reliable; however, Hexavest does not guarantee the accuracy, adequacy, or completeness of such information. Predictions, opinions, and other information contained herein are subject to change continually and without notice and may no longer be true after the date indicated. Hexavest disclaims responsibility for updating such views, analyses or other information. Different views may be expressed based on different investment styles, objectives, opinions or philosophies. It should not be assumed that any investments in securities, companies, countries, sectors or markets described were or will be profitable. It should not be assumed that any investor will have an investment experience similar to any portfolio characteristics or returns shown. This material may contain statements that are not historical facts (i.e., forward-looking statements). Any forward-looking statements speak only as of the date they are made, and Hexavest assumes no duty to and does not undertake to update forward-looking statements. Forward-looking statements are subject to numerous assumptions, risks, and uncertainties, which change over time. Future results may differ significantly from those stated in forward-looking statements, depending on factors such as changes in securities or financial markets or general economic conditions. Not all of Hexavest’s recommendations have been or will be profitable.

This material is for the benefit of persons whom Hexavest reasonably believes it is permitted to communicate to and should not be reproduced, distributed or forwarded to any other person without the written consent of Hexavest. It is not addressed to any other person and may not be used by them for any purpose whatsoever. It expresses no views as to the suitability of the investments described herein to the individual circumstances of any recipient or otherwise.