March: Enthusiasm abounds

April 6, 2021

Optimism regarding a normalization of the global economy continued to grow last month amid better-than-expected economic data, persistent fiscal and monetary policy support, and the vaccination campaign; more than 29% of the U.S. population have received at least one dose of a vaccine against COVID-191.

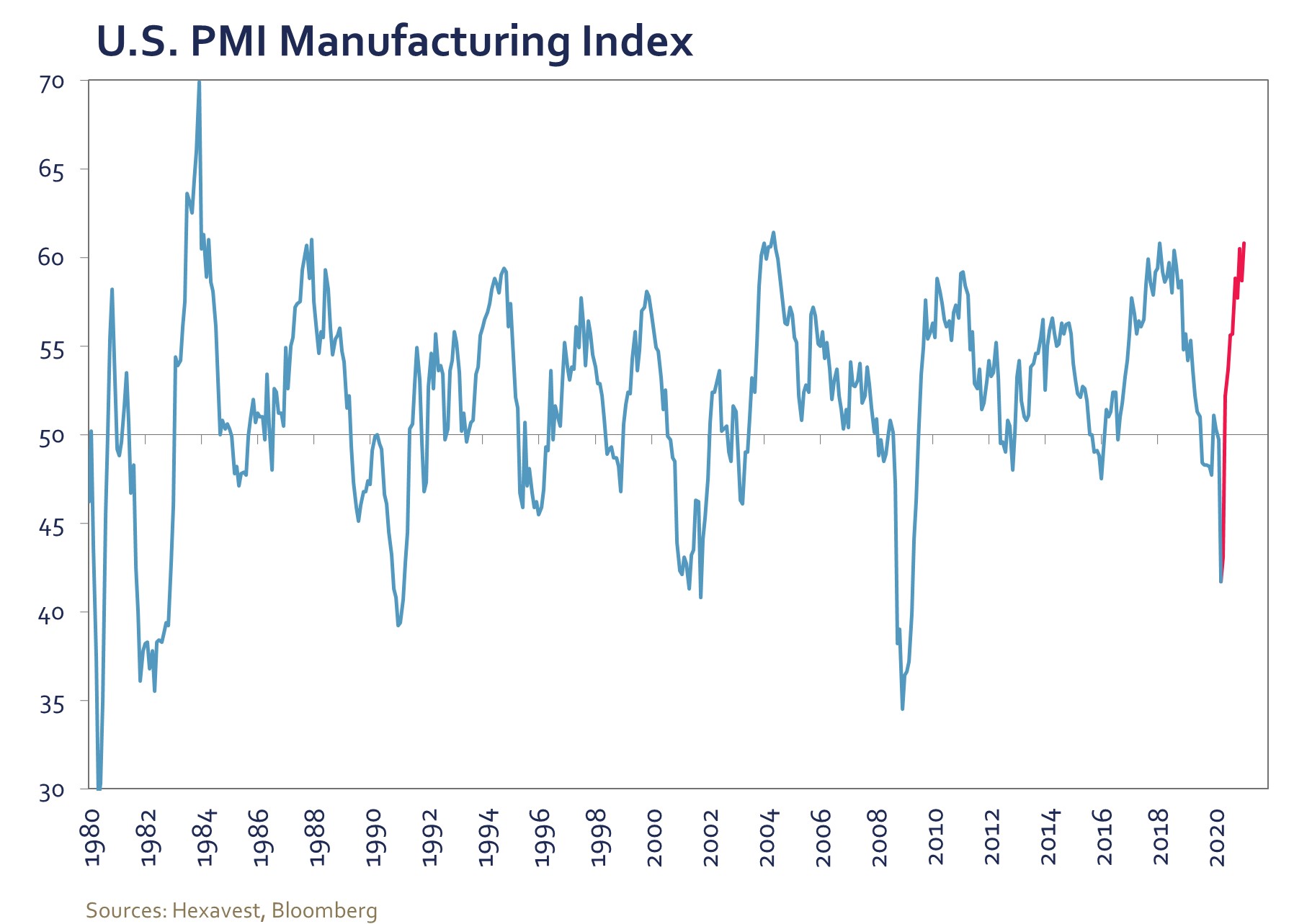

The U.S. government moved forward with its US$1.9 trillion stimulus plan2, providing a significant boost to consumer income. For every household with an income below US$150,0003, each member is set to receive US$1,400. Except for some of the most hard-hit service sectors, activity continued to broadly improve. However, some sectors are negatively impacted by supply-chain disruptions, particularly the automobile industry where supply for semi-conductor chips has been scarce.

President Biden further boosted confidence when he stated during his national address that America should be able to have small backyard BBQs4 on July 4th. In addition, he decided to double down his target of having 200 million vaccine doses administered during the first 100 days of his presidency5.

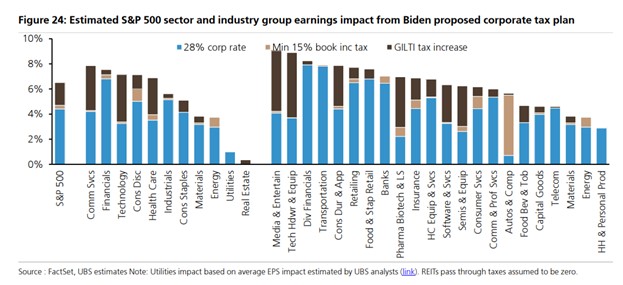

Discussions are now moving towards the next phase of the Biden economic stimulus plan: infrastructure spending. However, many questions remain, such as how this plan will be financed. The Biden administration is considering the largest tax increase since 19936, including raising the corporate income tax to 28% from 21%. This could have a meaningful negative impact on corporate profitability.

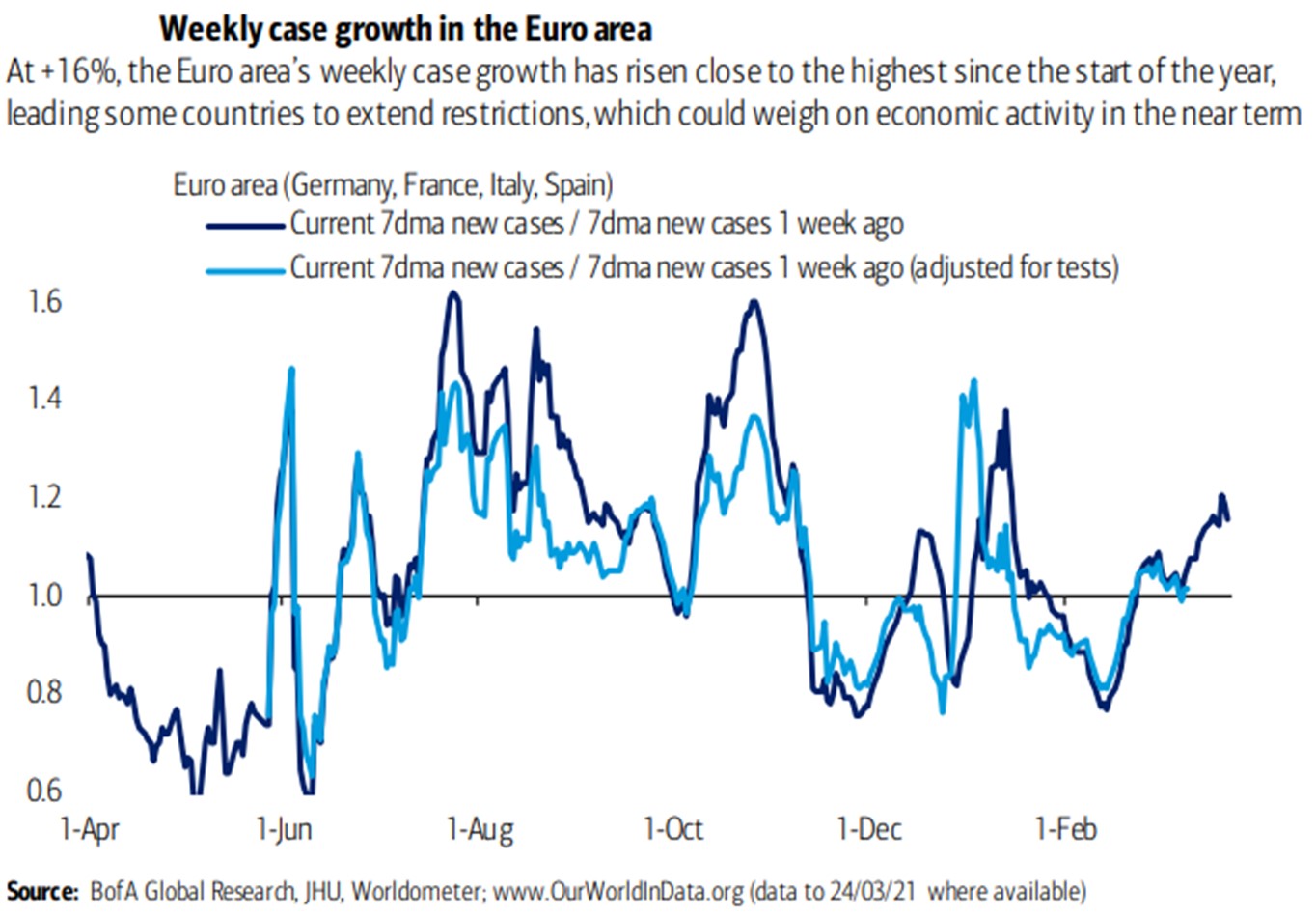

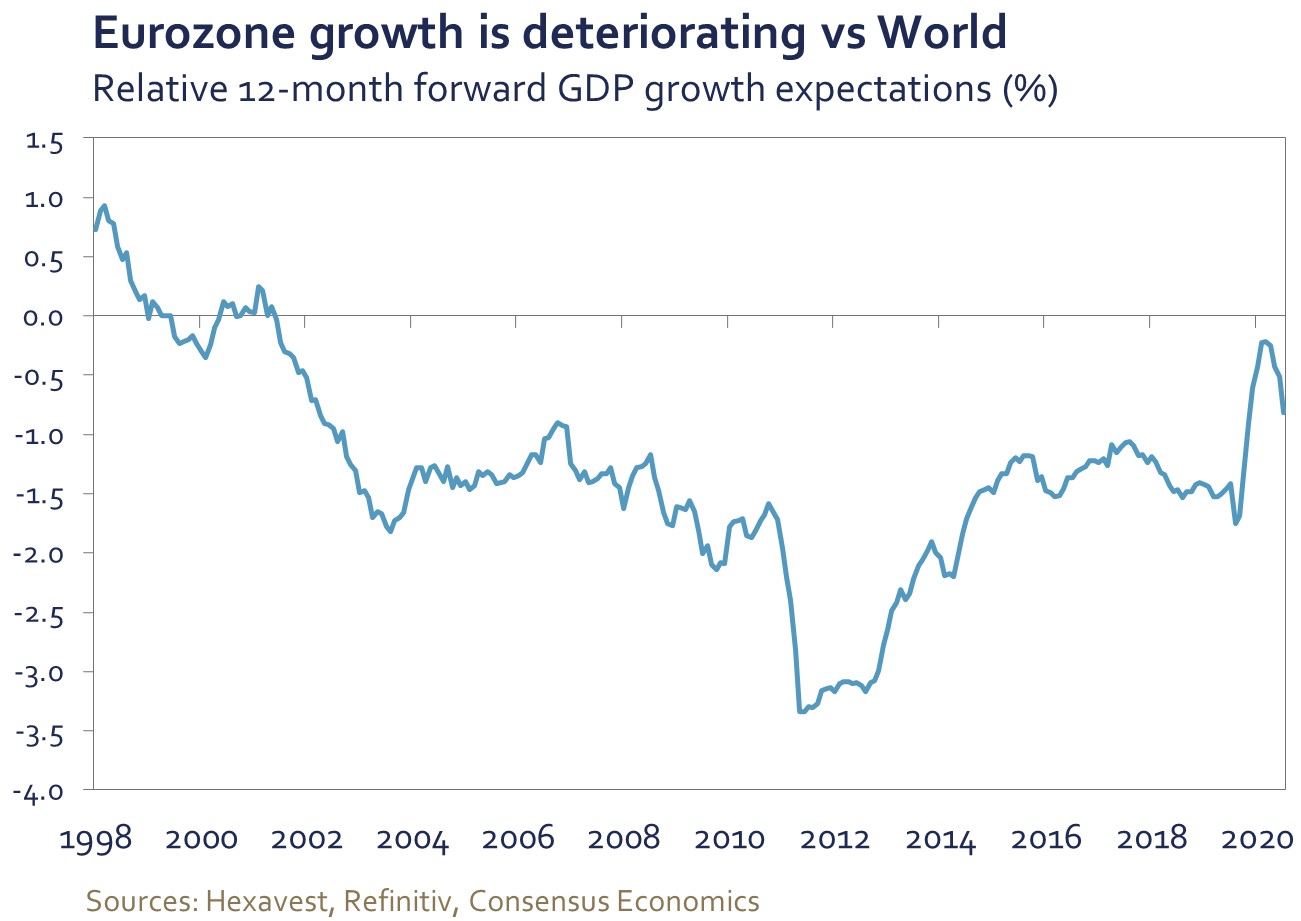

Across the pond, European nations are not vaccinating their population as quickly. The suspension of the AstraZeneca vaccine for a short period of time seems to put further stress on the vaccination campaign. At the same time, a worrisome increase in the number of new COVID-19 cases is forcing some national governments to extend restrictive measures. France broadened the restrictions applied to the Paris region to the whole country, including a nationwide school closure7. This will most likely push the economic recovery further into 2021 and increase the divide in economic growth trends between the U.S. and the U.K.

Despite an improving outlook, central banks remain committed to accommodative monetary conditions. Last month, in the much-anticipated FOMC meeting, Jeremy Powell reiterated that interest rates would remain low for an extended period although no significant changes to the policy mix were introduced. We believe the “dot plots”, an indicator of the Federal Reserve (Fed) interest rates outlook, demonstrated a more hawkish bias compared to the overall policy statement. As a result, risks are skewed towards policies tightening sooner than expected. The average weighted “dots” for 2023 moved up from 26 basis points (bps) at the December 2020 meeting to a little more than 40 bps this month. That being said, we are likely more than a year away from the Fed raising interest rates.

Market performance

Global equity markets rose last month, with the MSCI World gaining 4.2% in March, bringing the year-to-date gain to 6.1% in local currencies. Despite increased restrictions on mobility, Europe was the best performing region with a gain of 6.1% while a stronger U.S. dollar and rising interest rates weighed on emerging markets equities which fell 0.9%, resulting in a 3.5% monthly return for the MSCI ACWI index.

Just over a year ago, global financial markets were rocked by a broad economic shutdown as governments dealt with the pandemic’s initial blow. Yet, global equities recovered quickly with a gain of 50.7% for the MSCI World index over the last 12 months (51.1% for the MSCI ACWI).

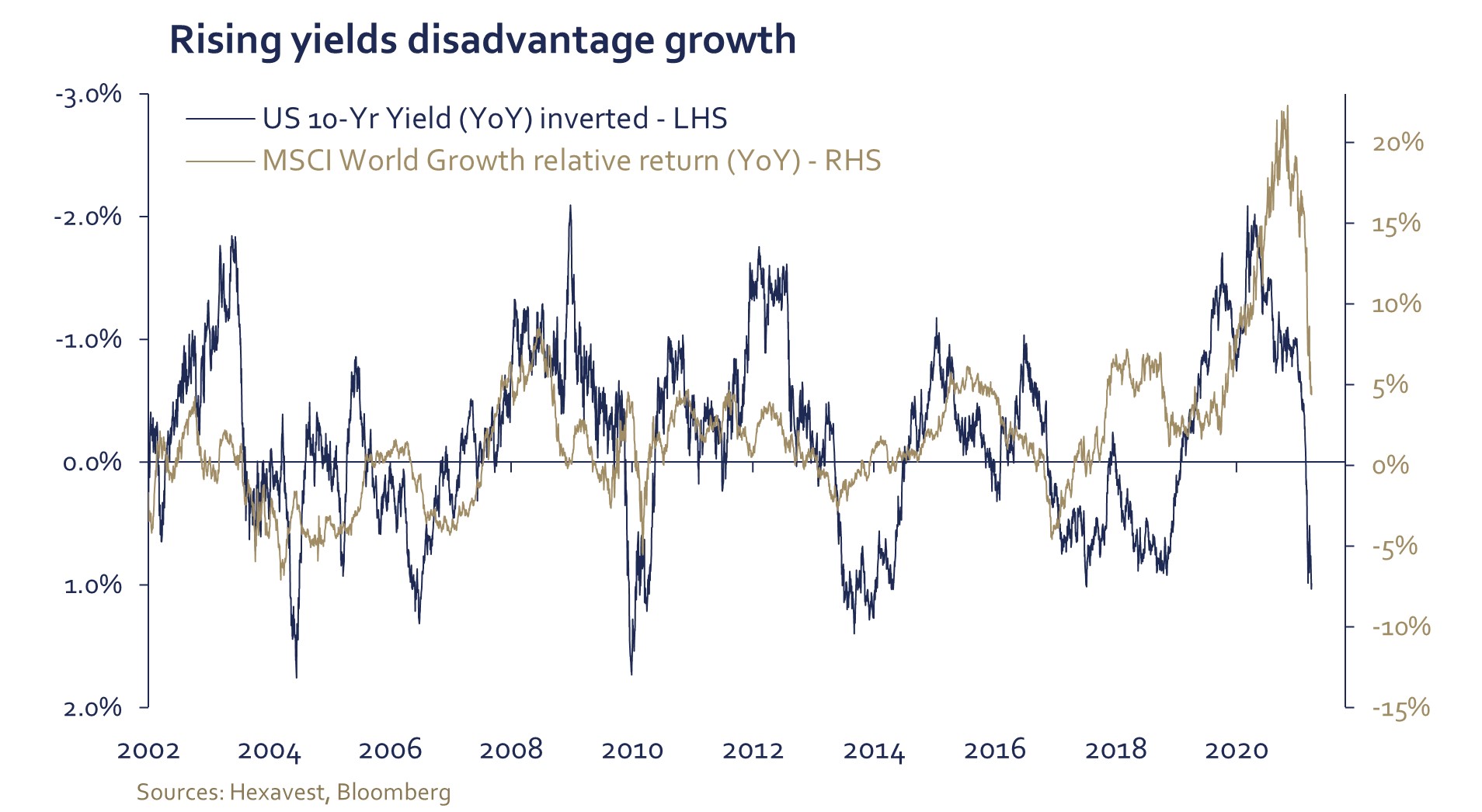

Improving growth prospects is driving interest rates higher with the U.S. 10-year treasury yield at 1.74%, an increase of more than 80 bps over the last 3 months. The Federal Reserve’s forward guidance has been enough to anchor short-term rates and, as a result, the U.S. yield curve continued to steepen with the difference between 2-year and 10-year bonds sitting at 1.65% compared to 56 bps six months ago.

Rising yields are a headwind for growth stocks; they only rose 1.7% in March (MSCI World growth index). Technology and communications services stocks underperformed significantly as optimistic investors turned their attention to less expensive cyclical sectors like energy, industrials, and financials.

Conclusion

Sentiment remains extended as investors continue to chase the pot of gold at the end of the rainbow. Investor’s focus has been fickle from one month to the next. In March, investors turned their attention to Volkswagen (VW). An upbeat review of Volkswagen’s electric vehicle program sent the company’s stock price exponentially higher. Similarly, the price of non-fungible tokens (NFT) has skyrocketed in March. NFT are a new class of financial instruments similar to a cryptocurrency with the specificity that it can only be used to purchase a unique product. One person bid more than $60 million dollars for an NFT for the purely digital work of the artist Beeple8. These examples show the extent to which euphoria remains clearly omnipresent in the market. Our proprietary Sentiment vector is also pointing towards the same conclusion. In addition, global equity markets remain expensive with most of the optimism around the re-opening of the economies now reflected in stock prices. Hence, we maintain our cautious stance.

1 Source: CDC, as at March 30, 2021. https://covid.cdc.gov/covid-data-tracker/#vaccinations

2 https://www.washingtonpost.com/us-policy/2021/03/10/house-stimulus-biden-covid-relief-checks/

3 https://www.kiplinger.com/taxes/602392/third-stimulus-check-faqs

4 https://www.nbcnews.com/news/morning-briefing/biden-sets-july-4th-goal-he-outlines-path-post-covid-n1260813

5 https://www.whitehouse.gov/briefing-room/speeches-remarks/2021/03/25/remarks-by-president-biden-in-press-conference/

6 https://www.bloomberg.com/news/articles/2021-03-15/biden-eyes-first-major-tax-hike-since-1993-in-next-economic-plan and https://www.whitehouse.gov/briefing-room/statements-releases/2021/03/31/fact-sheet-the-american-jobs-plan/

7 https://www.gouvernement.fr/info-coronavirus

8 https://www.cnbc.com/2021/03/11/most-expensive-nft-ever-sold-auctions-for-over-60-million.html

Important Information and Disclosure

Source of all data and information: Hexavest and MSCI as at March 31, 2021, unless otherwise specified.

This material is presented for information and illustrative purposes only. The opinions expressed in this document represent the current, good-faith views of Hexavest at the time of publication and are provided for limited purposes, are not definitive investment advice, and should not be relied on as such. The information presented herein has been developed internally and/or obtained from sources believed to be reliable; however, Hexavest does not guarantee the accuracy, adequacy, or completeness of such information. Predictions, opinions, and other information contained herein are subject to change continually and without notice and may no longer be true after the date indicated. Hexavest disclaims responsibility for updating such views, analyses or other information. Different views may be expressed based on different investment styles, objectives, opinions or philosophies.

All references to the “Hexavest ACWI equity portfolio”, to the “ACWI Equity representative portfolio”, to the “portfolio”, or to their performance in this document refer to an actual portfolio managed by Hexavest which is used to objectively represent the firm’s Global ACWI Equity strategy. The performance of this representative portfolio has been included in Hexavest’s ACWI Composite (Composite) since its inception in 2014. The Composite includes portfolios that invest primarily in equities of companies located in the developed markets and emerging markets of Americas, Europe & Middle East and Asia Pacific. Hexavest uses an investment approach that is predominantly “top-down” to construct diversified portfolios that typically contain more than 275 stocks. Asset allocation between regions, countries, currencies, and sectors can deviate substantially from that of the benchmark. Some portfolios may invest a small portion of their assets in countries and currencies not included in the benchmark. A client’s actual holdings, performance and investment experience will be different from that shown.

Gross-of-fee performance results are presented before management and custodial fees but after all trading commissions and withholding taxes on dividends, interest and capital gains, when applicable. Such fees and expenses would reduce the results shown. Fee levels may vary from client to client depending on the portfolio size and the ability of the client to negotiate fees.

The MSCI ACWI Index is a broad-based securities market index and used for illustrative purposes only. The MSCI ACWI Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets. Performance for the MSCI ACWI Index is shown “net”, which includes dividend reinvestments after deduction of foreign withholding tax. Broad-based securities indices are unmanaged and are not subject to fees and expenses typically associated with managed accounts or investment It is not possible to invest directly in an index. MSCI data may not be reproduced or used for any other purpose. MSCI provides no warranties, has not prepared or approved this document, and has no liability hereunder.

Past performance does not predict future results. This material may contain statements that are not historical facts (i.e., forward-looking statements). Any forward-looking statements speak only as of the date they are made, and Hexavest assumes no duty to and does not undertake to update forward-looking statements. Forward-looking statements are subject to numerous assumptions, risks, and uncertainties, which change over time. Future results may differ significantly from those stated in forward-looking statements, depending on factors such as changes in securities or financial markets or general economic conditions. Not all Hexavest’s recommendations have been or will be profitable. Investing entails risks and there can be no assurance that Hexavest will achieve profits or avoid incurring losses. It should not be assumed that any investor will have an investment experience similar to returns shown.

This material is for the benefit of persons whom Hexavest reasonably believes it is permitted to communicate to and should not be reproduced, distributed or forwarded to any other person without the written consent of Hexavest.